Big data analytics is an effective solution for identifying behavioral patterns and establishing strategies to help detect and prevent fraud in various business sectors.

Fraudulent activities such as e-commerce scams, cybersecurity threats, identity theft, forged bank checks, money laundering, tax evasion, fraudulent insurance claims, and financing fraud pose significant risks to users and companies. These risk activities are widespread in different industries, including retail, insurance, banking, healthcare, and insurance.

In light of the current situation, companies are increasingly focus on incorporating advanced fraud prevention technologies and risk management approaches that rely on Big Data. For example, Predictive Analytics models, Alternative Data and advanced Machine Learning techniques are helping decision-makers to develop new strategies and methodologies to prevent fraud.

In this article we will cover the following topics:

Which industries have been more vulnerable?

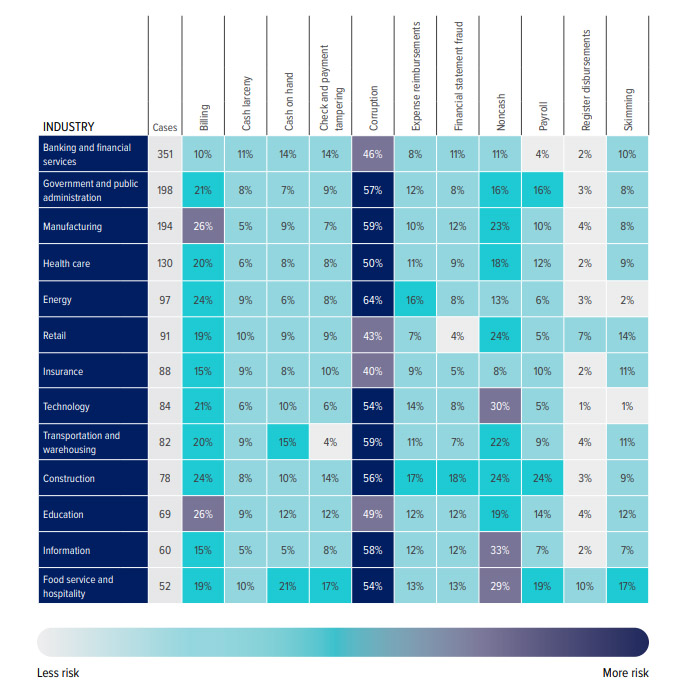

According to ACFE Report to the Nations, the most vulnerable industries for fraud are:

- Banking and financial services

- Government and public administration

- Manufacturing

- Healthcare

- Retail

- Energy

- Insurance

- Transportation and warehousing

- Technology

- Construction

Case: Where are retailers and merchants most vulnerable?

4 in 10 merchants use Machine Learning to improve fraud management and payment routing according to a Global Fraud Report from 2022.

- Fraud attacks such as phishing/pharming, card testing, identity theft, and first-party misuse are still the most common and affect over 30% of merchants worldwide.

- On a global scale, merchants believe that about 16% of fraudulent disputes are caused by first-party misuse, also known as “friendly fraud.” Most disputed transactions result from cardholders attempting to obtain free goods, confusion regarding transaction descriptions, or issuers incorrectly filing disputed transactions as fraud.

- 90% of merchants have faced fraud management challenges. The most common and significant challenges include identifying and responding to fraud attacks.

Detecting and preventing fraud with fraud data analytics and Big Data

Fraud analysis combines technology and human expertise to identify suspicious transactions related to fraud or bribery. This process can occur both before or after the transactions are completed.

To prevent fraud and bribery, companies use fraud analytics. This involves collecting and storing data, analyzing it to detect patterns and discrepancies, and translating the findings into insights. By doing so, companies can manage potential threats before they happen and create a proactive detection environment.

“Corruption, and abuse are unrelenting—and constantly evolving. It’s a different world out there.

Deloitte

And fraud analytics can help make sense of it.”

Now, fraud detection analytics has become more precise and efficient thanks to Big Data analysis. By employing Data Mining and Machine Learning models, trends, patterns, and behaviors can be identified to detect and prevent suspicious activities in different areas such as purchasing processes, credit activities, accounts or transactions, as well as internal and external processes.

Using Big Data for fraud detection enables organizations to identify fraudulent activities quickly. This is achieved by consolidating, mapping, and normalizing large amounts of data for practical analysis. Through this, organizations can create strategies that identify anomalous trends, detect cyber attacks, or detect security breaches.

Some use cases for fraud detection using Big Data Analytics are:

- Identify irregular and unusual patterns, business problems, or risk areas where activities or processes may result in fraud.

- Detects anomalies across channels, comparing data from different information sources to find discrepancies, such as social networks, databases, call centers, etc.

- Predicts suspicious activity before it causes damage to an organization’s assets or goods.

- By analyzing internal processes, this approach can pinpoint areas where fraud is more likely to occur. This allows for the development of business strategies that are better suited to the specific operations of the company.

We recommend you reading: Big Data for Effective Supply Risk Assessment

Which benefits can you obtain from implementing fraud detection using Big Data analytics?

Identify fraud patterns that are not easily detectable. Big Data analytics can discover new patterns, trends, fraudulent schemes, and scenarios that traditional methods might miss.

Enrich existing strategies. Incorporating Big Data methodologies into your current approach doesn’t mean replacing it. Instead, it can be an additional layer that enhances your existing efforts.

Data-driven approach. Fraud analytics can pull data across your organization into one central platform, helping create an authentic, enterprise-wide approach.

Decision-making is based on reliable data. Which actions are working? Which ones are not? Let data guide your decision-making.

Time to take the next step

As specialists in data analysis, at PREDIK Data-Driven, we can design an advanced ML model that will help you identify anomalies in payments and fraud problems in systems or processes, test the effectiveness of cybersecurity controls, and identify and predict patterns and behaviors in internal and external data sources processes where fraud can or is more common, among many others.