Identifying the right location to establish a business is a fundamental part of the basic strategy of any company in every industry. Selecting the exact right area and location is crucial not only for profitability, but also to help determine whether or not the business will be successful.

Iterative analysis of transaction, facility and asset data, along with geographic data, can provide valuable information that help all kind of retail businesses to choose the right location when establishing a site location. Without the right tools to manage large volumes of information and the help of GIS (geographic information system) a “traditional” data collection and analysis process would require a lot of time and money.

There are different optimization and suitability models for mobility-tested areas. The transformative potential of this type of analysis in the investment and selection of new locations is great, as it allows predicting the impact of important decision factors that may change over time and algorithmically optimizing location decisions.

Also read: “Geospatial data applied to the retail sector.”

PROBLEM

A U.S. hardware store chain, with hundreds of outlets in operation nationwide, needed, as part of its expansion strategy, to analyze new cities to determine their market potential and evaluate the opening of new outlets in those cities.

METHODOLOGY: EVALUATION OF AREAS WITH BIG DATA TECHNIQUES

In order to identify whether or not the cities have the potential to open new points of sale, and to determine within the cities the best locations to open new branches, PREDIK Data-Driven developed a methodology that collects geographic information, location and mobility data, pedestrian traffic with sociodemographic and subjective data on preferences and interests of the client potential customers.

First, it is necessary to define the profile of the client potential customer, which is done by taking into account the geographic location of the hardware store client online customer portfolio.

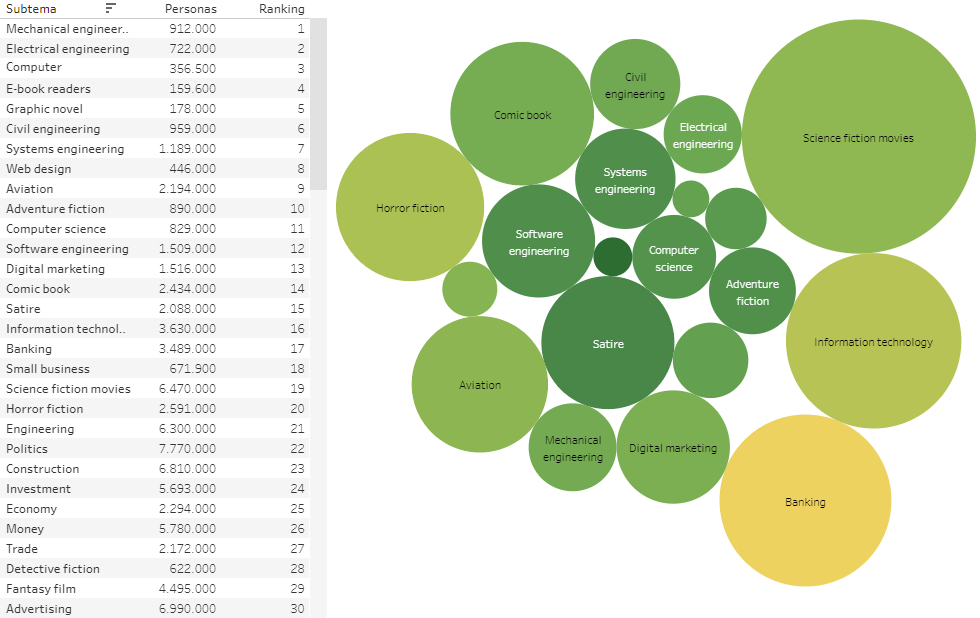

Then, the economic characteristics of potential customers are correlated, considering several variables of interest, including income level, consumer preferences and behavior patterns in social networks.

Subsequently, the characteristics of potential locations in the cities under evaluation are identified, and for this all relevant information is collected, both from locations where the client already has stores and locations of interest, such as:

- The population and its characteristics (income, spending composition).

- Economic and market evolution of the hardware store business in the cities of interest.

- Consumer preferences in social networks.

- Brand awareness in social media.

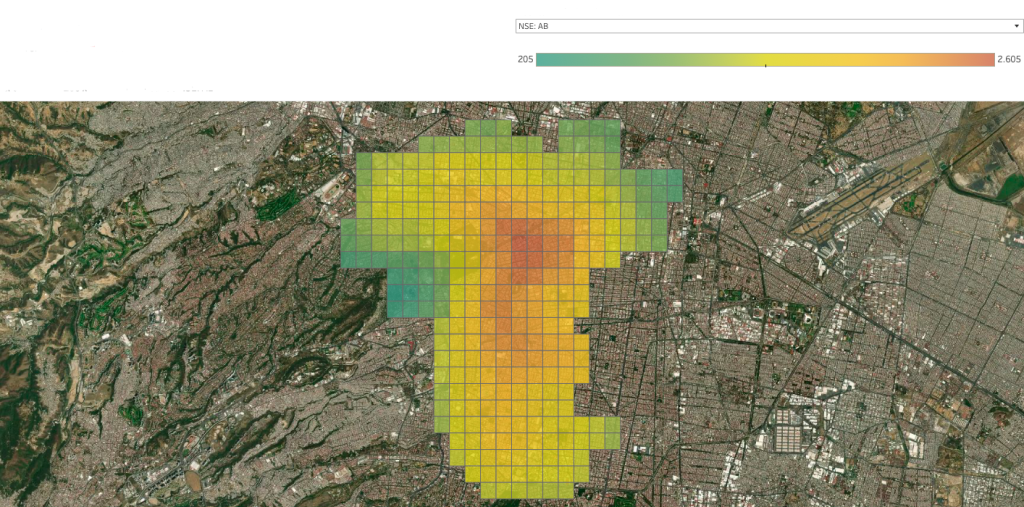

- Clustering and geographic segmentation, analyzing parcels and type of use (commercial, residential, etc).

Based on the customer profile, the number of potential customers is estimated using a methodology that is based on the company’s own turnover figures, in this case, the hardware store chain. The customer shares the sales figures for each store, as well as the average ticket sales. This information is essential for estimating the potential sales of new outlets.

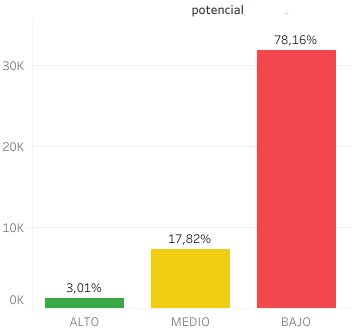

Subsequently, the commercial potential of the cities of interest is evaluated. By analyzing the characteristics of each potential location, the results of the analysis are compared with the characteristics of the cities where the client already has its points of sale. This comparative analysis is also done considering the performance of each store, market saturation and the number of total potential customers detected.

You may be interested in: “Industrial Localization and Big Data.”

The final product is a list of locations of interest ranked by their business potential, including a sales estimate for each potential new store.

Contact us for more information about our solutions with Geospatial data for the retail sector