The real estate industry has always been a data-driven business. Still, in recent years, Big Data Analytics has emerged as a game changer for this industry.

With the ability to collect, process, and analyze vast amounts of data, real estate firms can now gain insights into market trends, property values, and customer behavior like never before.

This article will explore how Big Data Analytics is transforming the real estate industry and its many benefits.

- What is Real Estate Analytics?

- The power of combining traditional and alternative data for enhancing data-driven decision-making

- Four Benefits of Real Estate Analytics based on Big Data

- Better decision-making

- Real estate investments & financial risk reductions

- Better marketing and commercial strategies

- More Efficient Inventory Control

- The Role of Predictive Analytics in Real Estate

- Six elements to consider when choosing the right Real Estate analytics company?

- Bonus: Trends and challenges for the industry in 2024

- The future of Big Data in Real Estate

What is Real Estate Analytics?

Real estate data analytics is a process that enables real estate professionals to make informed decisions regarding the construction, development, investment, sale, purchase, rental, or management of a physical property or a real estate project.

Using data analytics in real estate involves gathering all the relevant information from different sources and analyzing it to produce actionable insights. Nowadays, brokers, investors, developers, owners, and other realty professionals rely on real estate data analytics to predict the profitability of an investment, determine the best time to buy or sell, find suitable locations for new project developments, conduct successful negotiations, and allocate marketing efforts.

Real estate data and analytics is helping real estate organizations to:

- Better analyze market trends and identify new necessities.

- Make more precise property values.

- Identify relevant consumer behaviors.

- Improve urban and residential development projects.

- Kep track of valuable mobility insights.

So, is data analytics useful for real estate? Short anwer is yes. In fact, data analytics has become crucial for Real Estate experts. For example, analysts can examine large areas and complex markets faster, easier and without having to visit each location.

According to a report by MarketsandMarkets, the global real estate analytics market can grow from $5.5 billion in 2019 to $13.4 billion by 2024 at a compound annual growth rate (CAGR) of 19.8%. This growth is being driven by the following:

- The increasing demand for near real-time and real-time data analysis.

- The growing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies.

- The need for predictive analytics in the real estate industry.

The power of combining traditional and alternative data for enhancing data-driven decision-making

For years, intuition and internal know-how were enough for real estate professionals to make strategic decisions. But now, there is an increasing need for quicker, more relevant, and actionable insights (Especially in the current real estate market, which has many elements to consider).

Not identifying relevant market shifts, new consumer trends, and changing user requirements can lead to failure and profit loss. That is why the modern context requires taking a step further from an organization’s internal data. This is where alternative data comes into play.

Nearly 60 percent of real estate professionals’ “predictive power” has come from nontraditional and alternative sources.

McKinsey&Company

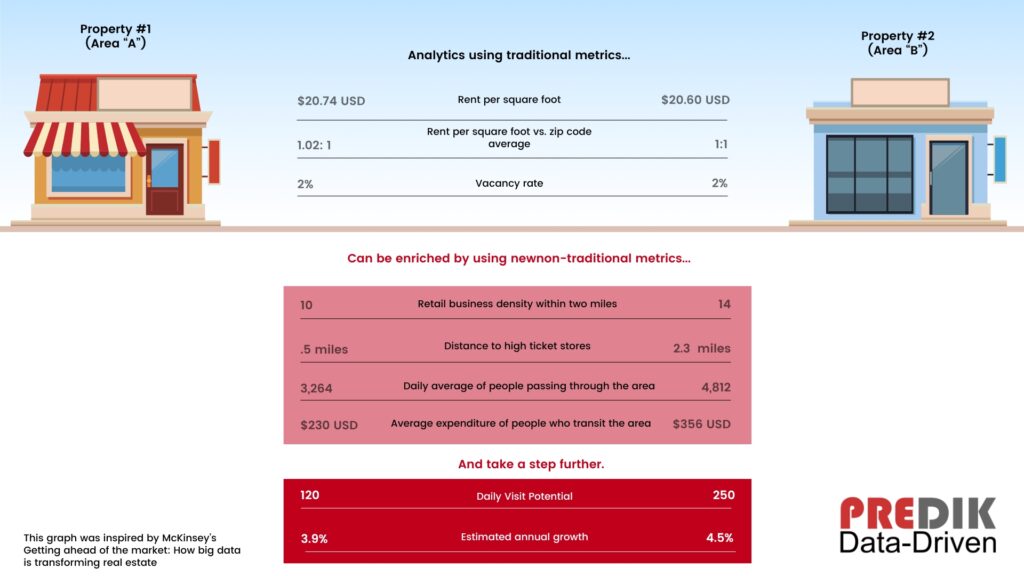

Conventional analysis can help you make some hypotheses, but everything changes when you base your decisions on millions of pieces of information. From foot traffic patterns and social media reviews to POI analysis and transactional data, using different sources of information improves accuracy and perspective.

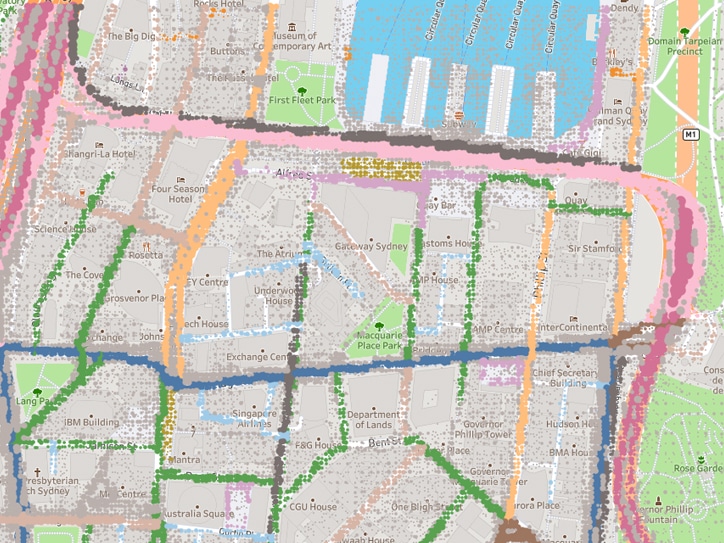

For example, some data-driven real estate investors use geospatial data, such as the number of pedestrians walking within an area, users’ average income range, or store visits, to improve their site selection strategies at a hyperlocalized level.

Four Benefits of Real Estate Analytics based on Big Data

As mentioned before, Big Data Analytics provides real estate firms with a more holistic view of the market, enabling them to make more informed and data-driven decisions. Uisng Big Data for Real Estate analysis can bring four main benefits:

Better decision-making

With access to vast amounts of data, real estate firms can gain a comprehensive understanding of the market. They can analyze market trends, customer behavior, and property values.

All this information helps them make informed and data-driven decisions. Through data analysis, decision-makers can develop effective strategies and tactics.

As Different explains, using a combination of internal and external real estate data can help agencies to get an accurate picture of their perfomance in a market context.

Real estate investments & financial risk reductions

Real estate investments can be risky (More often than not, markets can be unpredictable). However, investors and developers can make long-term decisions through Big Data Analytics.

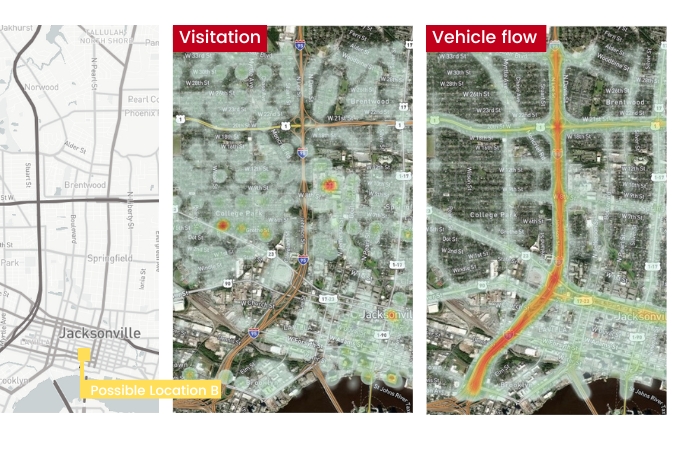

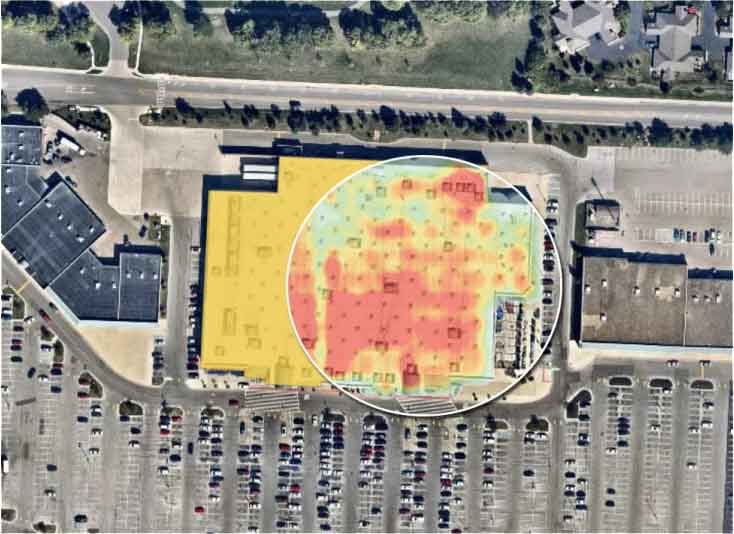

Big Data tools, like real estate heat maps, can help identify investment opportunities. With access to wider data sources, including property listings, historical sales data, and demographic information, you can gain valuable insights into the local real estate market.

But Big Data isn’t just about finding properties. It can also help determine the right price to pay. By analyzing historical sales data and comparing it to current market conditions, investors can better understand a property’s actual and future value.

Of course, investing in real estate is not only about finding the best properties and paying the right price. It’s also about managing investments effectively.

Real estate teams can better understand their investment properties’ performance by analyzing variables like vacancy rates, rental yields, and maintenance costs. Smart data analytics can even detect rent increases, property upgrades, and tenant screening decisions.

Better marketing and commercial strategies

How can real estate firms, agencies, and developers identify new and potential customers? Data analytics can bring the answers.

Data market research analyses customer behavior and preferences. The result? Better customer segmentation, effective marketing campaigns, and increased sales and profits.

Big Data Market Research provides real estate investors valuable insights into customer behavior. On the other hand, investors can make more informed decisions about their property investments by analyzing buying patterns, preferences, and trends.

More Efficient Inventory Control

Real estate firms and developers can use predictive analytics to manage inventory effectively. Advanced demand analysis and sales predictions secure the right stock according to specific consumer segment needs.

The Role of Predictive Analytics in Real Estate

Making smart decisions is crucial to success in this industry. That is why predictive analytics for real estate has become one of the essential tools for forecasting market aceptance and property potencial.

Predictive analytics is a form of data analysis that uses statistical algorithms and Machine Learning techniques to identify patterns in data and make predictions about future outcomes. This is how real estate professionals can gain insights into market trends, property values, and buyer behavior by leveraging market intelligence.

Learn more about Predictive Analytics: Read our complete guide

Some benefits of using predictive analytics in Real Estate

Property valuation: One of the most common applications is in property valuation. Predictive analytics models can be used to analyze a set of data points, such as historical sales data, local market trends, and property characteristics, to predict the value of a property.

Potential buyers: Predictive analytics helps identify and target potential buyers. Real estate professionals can identify the types of buyers most likely to be interested in a particular property by analyzing data on past buying behavior, demographic information, and other factors.

This information can help them target their marketing efforts more effectively and increase their sales chances.

Some limitations to consider

Of course, like any technology, predictive analytics has its limitations. There is always the risk of data bias or overfitting. Also, predictive models are only as good as the data quality. This is why it’s important to work with an experienced data company and use high-quality data to ensure that your predictive models are accurate and reliable.

Six elements to consider when choosing the right Real Estate analytics company?

When selecting a real estate analytics company, it is important to consider your organization’s specific needs and requirements for insights. Keep in mind that not all real estate data tools, systems, and information are created equal. To ensure you are choosing the right data analytics company, you should keep the following elements in mind:

1. Accuracy: The algorithms used to collect data must be optimized to accurately reflect the reality on the ground.

2. Granularity: Any location analytics provided should offer detailed insights into the specific attributes of actual places down to the property level.

3. Relevancy: Different datasets require different relevancy standards. Visitation data, for instance, should reflect changes over time. Demographic data should incorporate the most recent census and other available datasets.

4. Holistic approach: The system should integrate as much relevant data as possible, enabling users to consider all factors impacting their analysis.

5. Actionable approach: Any implemented solution should be user-friendly and accessible, providing actionable insights that guide your team to make the right decisions.

6. Privacy compliance: Every solution should be constructed with privacy in mind, ensuring that data is stripped from legal and privacy-compliant sources.

Are you looking for a reliable data analytics company for your project? At PREDIK Data-Driven we have over 15 years of experience working with Real Estate leaders around the world. Let’s talk about data

Bonus: Trends and challenges for the industry in 2024

From shifting consumer demands to the impact of technology, many factors at play will impact real estate companies. According to Professor Susan Wachter, 2023 was a “painful year” for real estate, but 2024 will not come easy either.

According to sources like Forbes or the National Assosiation of Realtor, some of the main trends for the Real Estate market will be:

- Increased buyer interest: Despite affordability challenges, 2024 could see a busier spring home-buying season than 2023.

- Inventory remains low: Existing homeowners locked in at low rates are unlikely to sell, keeping inventory low and putting upward pressure on prices.

- Mortgage rates and affordability: While rates have fallen from their 2023 highs, affordability challenges are expected to persist due to low inventory and high prices.

- Potential recovery: If inventory increases and mortgage rates continue trending downward, a housing market recovery could occur in 2024.

- New construction: Builder sentiment is improving, and new single-family building permits are ticking up, suggesting a potential increase in new construction.

- Foreclosures: While activity is trending up, it’s not expected to reach pre-pandemic levels due to strong economic conditions and high homeowner equity.

- Homeowners Staying Put: High-interest rates, steady home prices, and low inventory drive homeowners to stay put and renovate their existing spaces. Popular renovations include sustainable features, accessory dwelling units, pickleball courts, remodeled basements with saunas, media rooms, home offices, and outdoor spaces.

Some additional insights:

- The Federal Reserve is expected to cut interest rates in 2024, which could further influence mortgage rates and buyer demand.

- The affordability crisis may disproportionately impact first-time homebuyers.

- Technology like virtual tours and AI-powered property development is expected to play a more significant role in the real estate market.

The future of Big Data in Real Estate

The real estate industry benefits significantly from Big Data’s promises. As machine learning and data science continue to develop, real estate firms will have access to even more data points to analyze. This will lead to more precise insights and informed decision-making.

Embracing Big Data Analytics is increasingly crucial for success in this highly competitive market. Firms leveraging their data power will be better prepared for future challenges.

The real estate industry stands to benefit greatly from the potential of Big Data. As Machine Learning and data science continue to evolve, Real Estate organizations will be able to access a broader range of data points for analysis. This will result in more precise insights and better-informed decision-making.