Predictive analytics has significantly impacted the real estate sector, as it offers fast and accurate insights that can be acted upon. This change has been facilitated by the rise of Big Data and Geographic Information Systems (GIS), which tap into the vast potential of real estate data.

As usual, the real estate industry is continuously changing. For instance, there has been a surge in demand for sustainable and eco-friendly homes. Additionally, the homebuying experience is changing with the rise of virtual and augmented reality technologies, which cater to the trend of online home buying.

Also, the demand for city living and multifamily housing is increasing due to urbanization and generational preferences. However, rising home prices and stagnant wages make affordability a significant issue.

These are some of many factors real estate professionals need to monitor to make accurate decisions constantly. Many companies use Big Data and Predictive Analytics to understand the market better.

In this article we will cover the following topics:

The Role of Data in Real Estate

Real estate investors, agencies, and brokers have relied on data for informed property evaluations and investments for years. However, the industry has evolved thanks to intelligent commercial real estate data advancements. For example, today’s brokers can use data-driven tools to analyze a residential area better and provide clients with valuable insights like more accurate investment forecasts.

A decade ago, data was primarily used to evaluate a property’s worth during a transaction. Investors would examine a commercial property’s rent rolls and revenue generated to estimate its value and then decide whether to purchase it or not.

Now, investors have access to a wide range of data that allows them to evaluate a property’s potential return and risk thoroughly. Flood maps, demographics reports, traffic counts, tenant and retailer information, and EPA reports are just a few examples of the information that can provide a clear picture of a building’s ROI from the beginning.

This comprehensive approach to analyzing a property’s physical and human components is a significant advancement.

You may also like to read our specialzed guide: Real Estate Data Analytics (A Guide for Decision-Makers)

Predictive Analytics in Real Estate: The Next Step for Strategic Decision Making

Our experience working with real estate experts worldwide confirms that most real estate pros base their decision-making process on past data. This causes them a big problem: They cannot keep track of a fast-moving real estate environment.

Predictive analytics in commercial real estate and property investing helps companies to get a more comprehensive vision. How? Predictive models gather not only historical data but also use external data and alternative data to estimate future outcomes.

Predictive analytics tools take data analysis to the next level to estimate future outcomes based on how past and present events occurred. Consumer demographics, housing trends and property price history are some of the areas where predictive analytics represent a huge opportunity for the industry.

For example, a developer firm may consider purchasing properties in a specific area of Los Angeles. To make an informed decision, a predictive analytics model can analyze satellite images to determine any damage caused by floods, fires, or other factors over time. This analysis can provide an accurate forecast of the property’s value.

Additionally, the model can evaluate factors like foot and vehicle traffic and commercial and residential data to determine whether investing in the area is wise.

Understanding the Different Real Estate Predictive Analytics

One of the best things about predictive models is that they can adapt according to specific approaches and data requirements.

Predictive Models for Real Estate Agents

By analyzing local housing upgrades and improvements, predictive models can identify the type of properties buyers are willing to pay more for or the condition of the property they expect at a given price. This helps to improve the quality of buyer and seller leads, generate more homes for sale, match property buyer leads with the proper listing, and decrease the cost of customer acquisition, among other benefits.

Predictive Analytics in Real Estate Investing

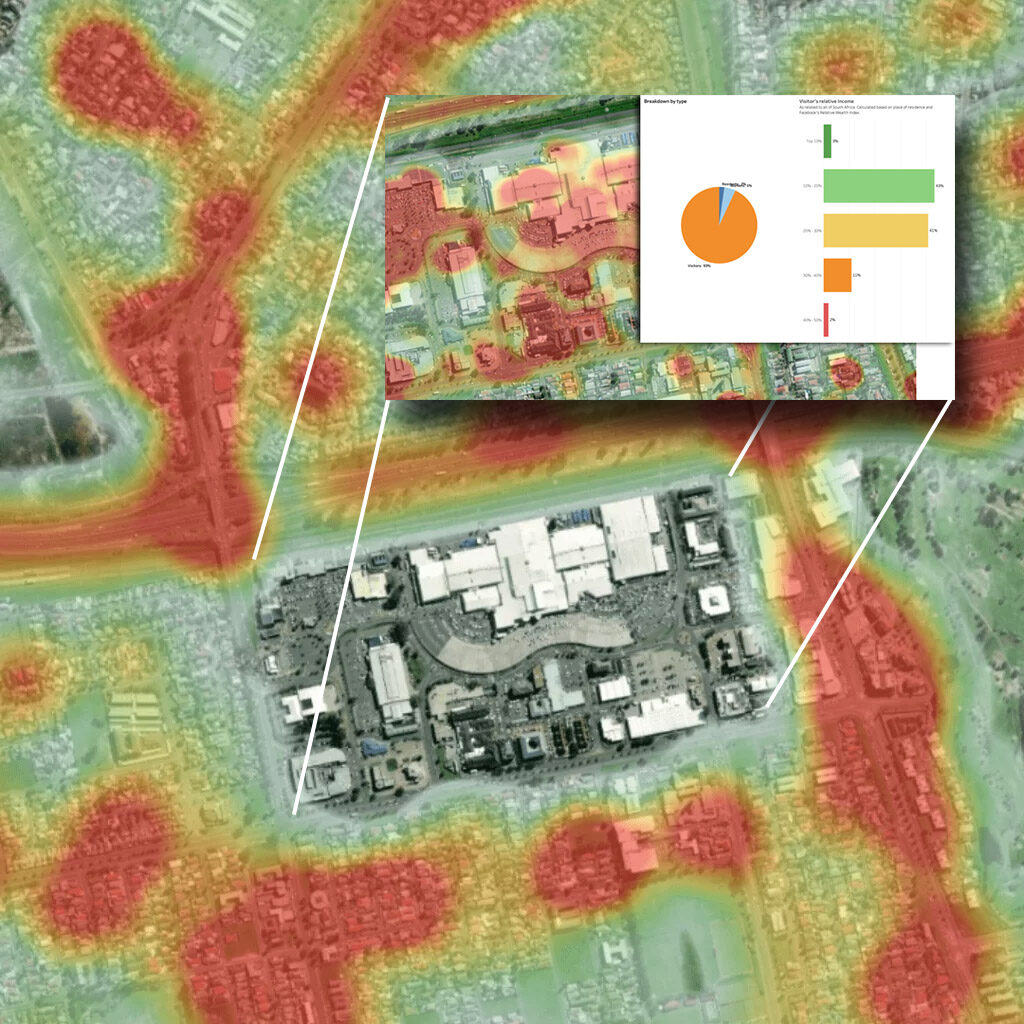

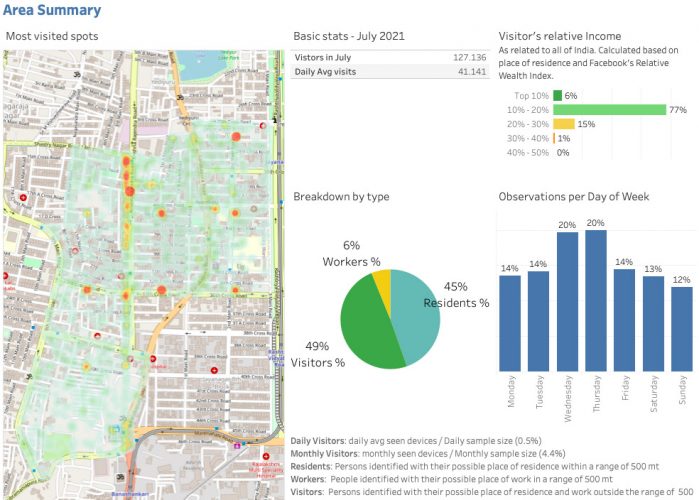

Predictive analytics significantly eases the process of finding the best investment property. By analyzing large amounts of Big Data and using a heat map visualization, it is possible to identify the most promising areas in a particular city for investing in rental properties. This information helps investors choose the most suitable properties and maximize their profits.

Predictive models to Understand the Customer Journey

User data identify potential consumers in a target market. This helps real estate professionals understand the buyer’s journey and reach potential home buyers.

We recommend you reading: How to Get Useful Customer Behavior Analytics? (Guide)

Predictive Models in Real Estate Marketing

Real estate predictive analytics can predict preferences and trends deriving into potential purchases by analyzing a user’s behavior and purchase history. This enables sales reps to prioritize leads that will bring the most value to the business.

Benefits of Real Estate Predictive Analytics

More accurate property value estimations

When real estate agents and brokers set a property’s selling price, they consider factors such as location, neighborhood characteristics, and potential buyers’ trends.

However, predictive analytics can provide even more comprehensive analysis. A more precise estimation of the property’s future value can be made by examining data insights such as consumer spending, demand for similar properties, sociodemographics of residents and working groups, and income levels.

Rental Property Assessment

As a renter, it’s crucial to clearly understand the total cost of a property before making a decision. Similarly, investors are interested in determining whether a rental property is worthwhile in a specific location.

Predictive analytics can address both concerns. By analyzing data, predictive models can pinpoint properties that meet an investor’s budget and provide details on properties with the highest potential for a good return on investment.

Identifying the “hidden gems” before anyone else

Uncovering the “hidden gems” in the rapidly-changing real estate industry can be difficult. With so many locations and properties to consider, it can be overwhelming

Fortunately, predictive analytics offers a solution by allowing agents, consultants, and professionals to simultaneously analyze multiple points of interest (POIs). This comprehensively explains an area’s pricing trends and market dynamics.

Identifying opportunities and risks in a portfolio management

By examining data from different sources like market indicators, consumer patterns, demographics, economic indicators, and market trends, predictive analytics helps portfolio managers to identify potential risks and opportunities for their real estate investments.

Having the right insights enables decision-makers to take a strategic approach regarding buying, selling, or holding assets in their portfolios. Additionally, predictive analytics can assist managers in optimizing their portfolios by identifying underperforming assets and redirecting resources toward high-performing ones.

Do you know? Predictive analytics models can estimate which homeowners will likely sell their property in the new six or 12 months.

Going beyond real estate predictive tools

With the increasing development of AI, Machine Learning, and Big Data, more and more real estate pros, agents, and brokers are using some analytics solutions.

Popular real estate tools like Smartzip, Offrs, Likely.AI or Tophap use smart data and predictive analytics. They are helpful, no doubt about it. Still, robust predictive analytics models must be tailor-made based on your specific requirements and objectives.

Each business problem requires a specific approach to get the desired results. Not only that, data must follow a detailed process to get the best of predictive analytics. We are talking about finding the right data sources to analyze it properly.

Using predictive analytics as it should be

PREDIK Data Driven supports the real estate industry by helping them transition to predictive modeling and big data analytics. We can provide you with a specialized, tailor-made predictive analytics solution to enhance your decision-making and minimize investment risks.