Fundamental analysts find supply chain mapping tools handy for assessing a company’s value and making better investment decisions.

Big Data significantly impacts every industry, and finance is not the exception. Banks and stockholders are increasing their demand for predictive analysis and Big Data so much that the data market value in these sectors is expected to be worth up to 5.4 billion in 2026.

Some years ago, analysts had to deal with information delays from public and governmental companies and total secrecy from private companies. Everything has changed now that data has become more transparent, accessible, and precise.

Nowadays, analysts make decisions using data-driven tools that can interpret massive datasets containing prices, volumes, and statements. Additionally, alternative data allows firms to evaluate companies from geopolitical, economic, legal, and institutional angles.

Supply chain mapping tools: Just what fundamental analysts were asking for

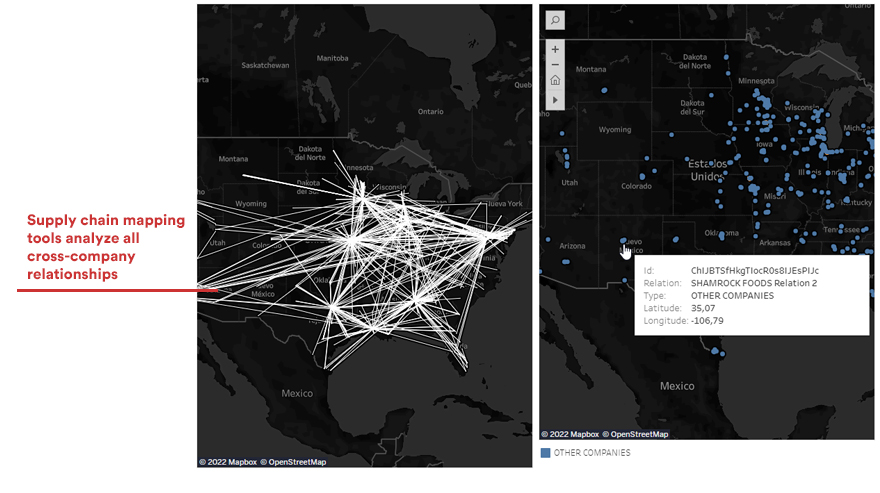

Companies commonly use supply chain mapping tools to understand all their cross-company relations and identify possible threats and opportunities. By mapping the supply chain, brands can classify first, second, and third tier relationships between public, private, and governmental entities.

That’s why fundamental analysts also find these tools handy for assessing a company’s value and making better investment decisions. Unlike technical analysts, they seek to examine all the qualitative and quantitative factors that can affect the security value of a company, including internal and external factors.

You may also like to read: A comprehensive guide to supply chain mapping

Identify risks inside a company

One of the main benefits of using supply chain mapping tools is that fundamental analysts can identify first, second, third tiers and more. This gives them a complete panorama of how well a company is doing, considering its relations with other companies such as suppliers and customers.

Analysts can get valuable insights that help them answer questions like:

- Is a company facing shortages in source materials?

- Are price fluctuations due to issues with a supplier?

- Is the company diversifying its supplier sources, or does it relies only on one?

- Is a company working with reliable entities?

- Will a company be able to fulfill its current and future demands?

- Is a company facing a conflict of interests within its business environment?

How external factors affect a company

As we mentioned before, fundamental analysts consider every external element that can impact the value of a company, from economic to geopolitical aspects.

For example, to consider a company from the food industry, fundamental analysts will try to understand if the Ukraine conflict or the plastic ban enforcement will affect their operations.

Supply chain tools classify all the tiers of a company, so it’s easier to identify each entity involved and analyze any possible connections with external threads.

Competitor analysis

To understand the positioning of a brand inside a particular market, analysts need to study all the other “players” in search of patterns and correlations.

Supply chain market tools help find answers to questions like:

- Which are the common obstacles companies are facing? What’s the strategy of each company?

- Issues like price fluctuations, delays, or shortages are a general market problem, or is it just isolated cases?

- Are all companies relying on a particular entity? Is there a conflict of interests between entities?

Analysis of illicit networks and illegal corporate assets

A corporate scandal can plummet the reputation of a company and its value. For example, Enron’s share prices went from $90.56 to a dollar after being involved in one of the biggest scandals in the US. When the SEC started the investigation of its irregular procedures, they discovered billions of dollars hidden through other Enron-controlled companies.

That caused the largest chapter-11 bankruptcy in history and several collateral damages to all the companies connected with Enron. Fundamental analysts have learned the lesson, so they try to anticipate scandals like those of Volkswagen, BP, Valeant Pharmaceuticals, or Kobe Steel.

Supply chain mapping tools can highlight every hidden relation between a company and any possible illegal entities.

How to use supply chain mapping tools for fundamental analysis?

Fundamental analysts are turning to digitalization and Big Data to make better decisions. Supply chain mapping tools allow a deeper understanding of a company’s risks and opportunities.

That’s why at PREDIK Data-Driven, we have developed a precise methodology that consists of:

1) Identify all the company’s internal and external sources of information.

2) Evaluate and analyze each data piece from all entities involved (even those hidden).

3) Determine correlations and patterns found between those entities.

4) Visualize and classify the whole supply chain with first, second, and third tiers relations.