The global health crisis and all the issues that came along affected most industries, but that wasn’t the case for the electronics and home appliances industry. Boosted by the increasing growth of e-commerce and the home economy, the online consumer electronics market expects to grow by over 10% yearly.

It’s important to note that during COVID-19, the main impact involved the massive closing of retail stores (50,000 US stores are at risk of closing over the next five years). Also, consumers put on hold their willingness to replace major appliances.

“In 2021, 63% of global sales in the consumer electronics sector happened through online channels.”

Forrester

Even though Household Appliances and electronics have been through a good run, the industry is subject to constant transformations, challenges, and requirements for innovation.

In this article we will cover the following topics:

- Relevant data for 2019-2022:

- Four players define the industry

- Home appliances trends for 2023 and years to come

- The role of Big Data for Competitive Intelligence strategies

- Challenges of building successful Competitive Intelligence strategies

- Competitive Intelligence…With a geolocation approach?

- Case Study: Analyzing a General Electric Appliance plant using geolocation data

- In conclusion

Relevant data for 2019-2022:

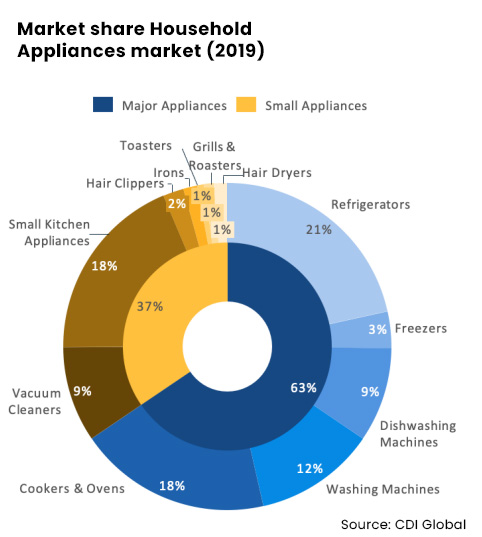

- In 2019, the major appliances segment got 21% of the total industry revenue (The refrigerator segment being the biggest). Small kitchen appliances got 18%.

- 2021 recorded the highest sales numbers. Growing segments like robot vacuum cleaners have increased their popularity.

- In 2022, the general price increase and the inflation threat slowed the consumer market. Consumers are looking for cheaper options.

What about 2023?

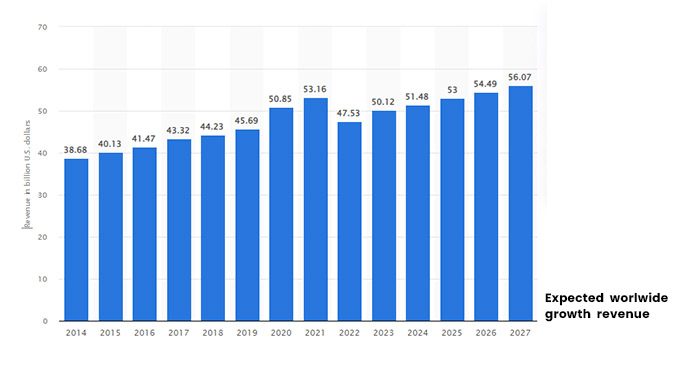

Worldwide the spending on household goods is expected to increase constantly at a CAGR of 4,9% between 2018 and 2023

Four players define the industry

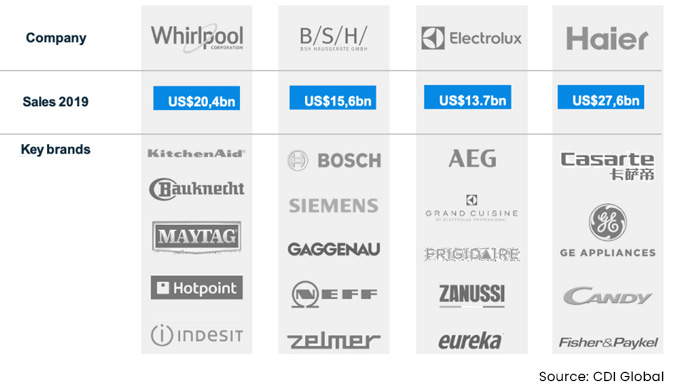

Four key players represent the sale industry: Whirlpool, BSH, Electrolux, and Haier. According to Statista, in 2019, the leading company was Whirlpool, with US$20.4 billion.

Whirlpool

Their portfolio comprises seven brands KitchenAid, Bauknecht, Maytag, and Indesit. Whirlpool targets 90% of global consumers.

According to their reports, the brand is well positioned to deliver a strong 2023:

- Full-year GAAP net loss margin of (7.7)% and GAAP loss per diluted share of $(27.18) driven by EMEA transaction, recorded in the fourth quarter.

- Full-year ongoing (non-GAAP) EBIT margin(1) of 6.9% and ongoing (non-GAAP) earnings per diluted share(2) of $19.64 in a challenging macro cycle.

- Q4 GAAP net loss margin of (32.6)% and ongoing (non-GAAP) EBIT margin(1) of 3.5%, impacted by a one-off supply chain disruption in North America.

B/S/H (Bosh and Siemens Home Appliances Group)

B/S/H has become Europe’s biggest major appliance manufacturer and the second largest worldwide.

These are three main keys of their Q4 2022 report:

- Revenue for the fourth quarter climbed 18% year-over-year, to €20.6 billion, while orders increased 14% year-over-year, reaching €21.8 billion, for a book-to-bill ratio of 1.06

- Revenue rose 12% and orders grew 7% on a comparable basis, excluding currency translation and portfolio effects

- Profit Industrial Business climbed 38%, to €3.2 billion, with a profit margin of 16.2%, on profit increases in all industrial businesses

Electrolux

Electrolux emphasizes sustainability and smart appliances. In 2019, the brand realized a total revenue of US$13.7 billion. Different from the positive perspective of its competitors, Electrolux summarizes Q4 2022 as a “Weak finish to a challenging year.”

- In the fourth quarter, net sales amounted to SEK 35,769m (35,372) and operating income to SEK -1,964m (882), corresponding to a margin of -5.5% (2.5).

- Operating income includes non-recurring items of SEK -1,352m (-727). Excluding these non-recurring items, operating income amounted to SEK -612m (1,609), corresponding to a margin of -1.7% (4.5). The year-over-year decline was a result of lower volumes in all four business areas and significantly higher cost levels in Business Area North America, which reported an underlying loss of SEK 1.2bn.

- Income for the period amounted to SEK -1,922m (596) and earnings per share were SEK -7.12 (2.09).

“In 2022, new challenges presented themselves in addition to supply chain constraints: high general inflation, increased interest rates, soaring energy prices, and increased geopolitical tensions. These negatively impacted consumer demand for household appliances, especially evident in the latter part of the year.”

Jonas Samuelson, Presindent & CEO of Electrolux Group

Haier

Haier Electronics have shown the highest rates within the household appliances market. The brand expects a 12.2% year-over-year growth.

Home appliances trends for 2023 and years to come

- Smart technology is growing the whole industry. Gadgets like Amazon Echo or Google Assistant are increasing the demand for connected household appliances (from laundry machines to dishwashers).

- Technological shifts towards more environment-friendly and energy-efficient products. Users are demanding more efficient appliances and more durable and energy-saving products.

- Less demand for premium products. Even though premium products are still in high order, their percent growth is slowing down compared to 2021.

The role of Big Data for Competitive Intelligence strategies

Without question, the home appliance industry is facing significant worldwide swifts. Consumers are looking for more efficient, environmental-friendly and cheap products, while competitors are launching aggressive strategies in the market.

Competitive intelligence consists of gathering key data from many sources to understand the market, rivals, and customers to foresee and prepare for new problems and dangers before they even happen.

We recommend you reading: Understanding Competitive Data: Benefits, Uses and Sources

Challenges of building successful Competitive Intelligence strategies

Competitive intelligence can be the special ingredient when preparing a successful CI strategy. However, in a highly demanding industry, such as house appliances, it can be challenging to stay in mind with consumers, keep up with competitors’ strategic moves, and be prepared against external threats.

Competitive Intelligence…With a geolocation approach?

Big Data, Artificial Intelligence, and Machine Learning solutions are now essential for the industry. More than ever, decision-makers can access vast datasets generated by their users, consumers, and even competitors.

Aware of the companies’ necessity to obtain meaningful insights, we’ve developed a new approach to Competitive intelligence analysis.

While most CI companies track their analysis around social media interactions, website behavior, and sales performance, we can obtain field intelligence through geolocation technology. The result? We’re able to analyze any company’s facility in the U.S.

We have developed a CI Solution that employs geolocation techniques and alternative data. Our solution provides a new way to understand your competitors, suppliers, and customers.

Our clients are using our in-depth analysis to understand their markets and supply chains while revealing and presenting hidden connections between different companies.

Our methodology identifies movement patterns and connections between target locations and other facilities and companies.

Using specialized machine-learning algorithms, sensor and POI data, and building footprints, we can draw connection maps between your competitors and their business environment (customers, suppliers, distributors, and more).

Note: Right now we are able to compile over 62, 000 data variables.

Case Study: Analyzing a General Electric Appliance plant using geolocation data

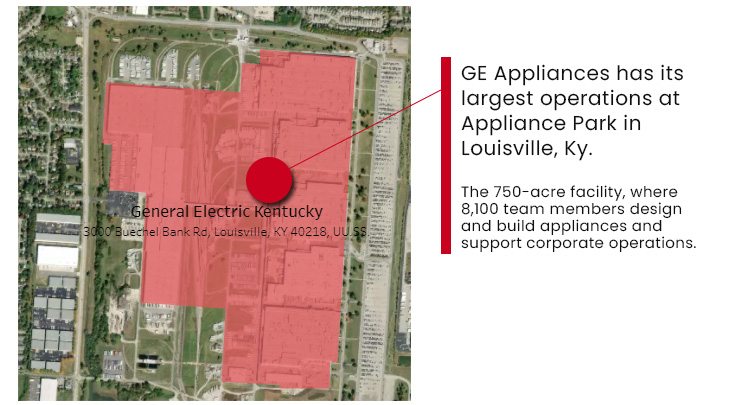

Kentucky’s GE Appliance plant is one of the brand’s most important locations in the U.S.

In 2022 they announced an investment of US$450 million to increase their operational capacity to launch new products for the following years (Especially refrigerators and laundry machines).

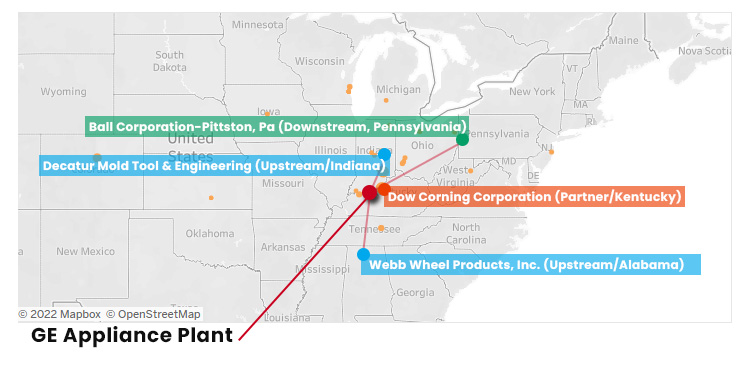

Using our Competitive Intelligence Tool, we can analyze every business relationship involving this plant. For example, our analysis shows GE keeps business relationships with manufacturers such as:

- Webb Wheel Products, Inc. (Upstream/Alabama)

- Decatur Mold Tool & Engineering (Upstream/Indiana)

- Dow Corning Corporation (Partner/Kentucky)

- Ball Corporation-Pittston, Pa (Downstream, Pennsylvania)

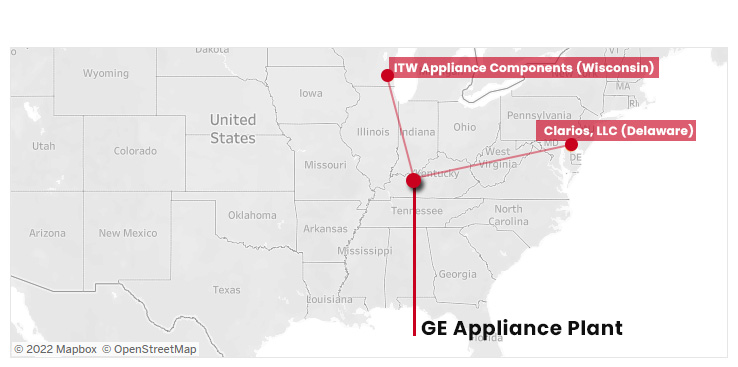

Also, we found that Clarios, LLC (Delaware) and ITW Appliance Components (Wisconsin) are some of their electronic parts suppliers.

Do you want to see our full GE analysis? You can contact us for a full copy

In conclusion

The right Competitive Intelligence solution has become crucial for a fast-shifting household and appliance sector.

With our new CI approach, companies can easily identify growth opportunities and improve their product portfolio by understanding the strengths, weaknesses, and market changes (Including competitors).