In order to research and evaluate real estate investment opportunities for commercial, industrial, or hospitality use, it is important to consider all social and economic factors in a given area in order to make an informed investment.

Researching and evaluating real estate investment opportunities is not a piece of cake. Whether it is the valuation of a retail or hospitality investment space, it is crucial to take into account all the socio-economic factors of the area in question to ensure a high return.

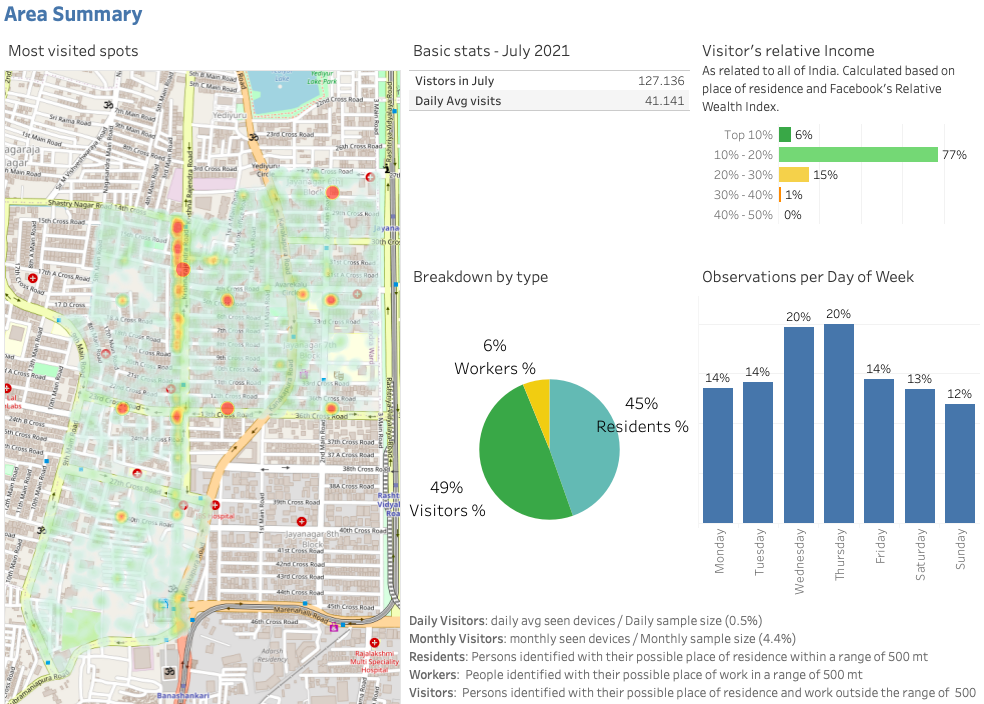

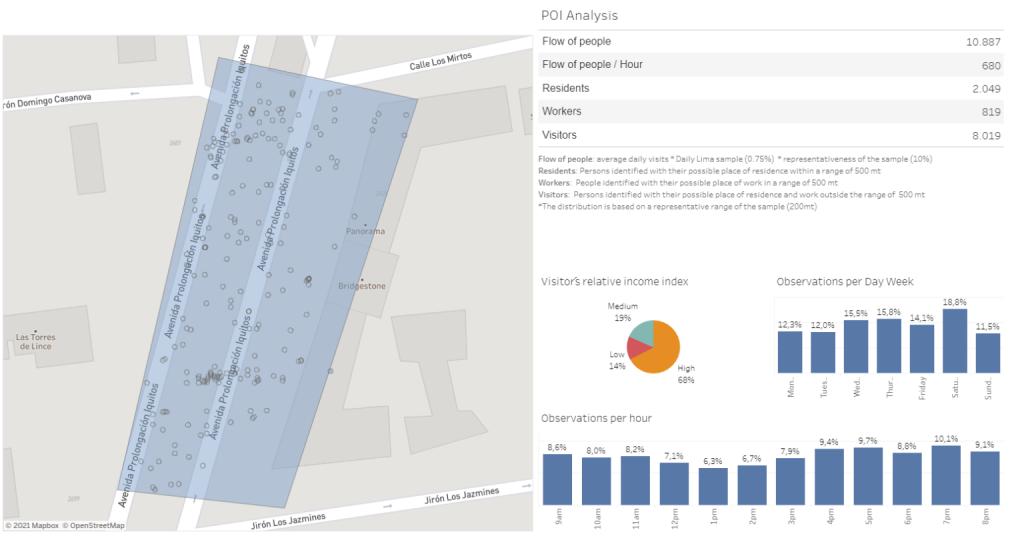

New technological tools such as location intelligence that provide detailed information about locations or footfall analytics, which identifies pedestrian mobility patterns, vehicular traffic trends, busiest times of day, and characterization of points of interest, make it possible to identify visitor behaviors and demographics around locations or areas of interest.

You may be interested in: “How to use Big Data in the real estate market?“

Real estate development groups are turning to these tools to answer complex questions:

- How can I identify new areas and zones of interest for potential investment?

- How can I better identify and understand risk when making a new investment?

- How can I use available data to better inform my real estate investment strategy?

- What new areas are a lucrative option for potential investment?

- What are the associated risks I should identify when making a new investment?

- Who are my competitors, and can I follow their decision patterns to gain better insights?

Also read: “Footfall analytics: San Pablo Vs. Guadalajara Pharmacies“

Real estate companies get the solutions, through these tools:

Understanding consumer demographics

With hotspot characterization, the typical demographics of an area in which an investment is being considered are identified, helping to understand and analyze the long-term potential of an investment opportunity, visualizing trends in income, education, the population’s cost of living, behavioral traits, their professional preferences, etc., ensuring that any investment is targeted to an area that fits the wants and needs of investors, desires of customers and secures a lucrative business.

Real estate site selection

Mobility (foot traffic) analytics provide a better understanding of the locations that target consumers visit most frequently, their preferences, and movement patterns around specific areas of interest by identifying the number of visitors, length of visit, time of visit, demographic information, and the number of times consumers visit an area or location. Investing in an area where target consumers already visit and shop ensures the right type of foot traffic and set the investment up for success.

Trend detection

Location intelligence also allows detecting neighborhood trends in advance to know whether or not to invest in an area before anyone else, by detecting if area trends are not consistent with investment or if foot traffic patterns suggest a lower rate of consumer visits, an investor might be able to sell their investment while the market is still good.

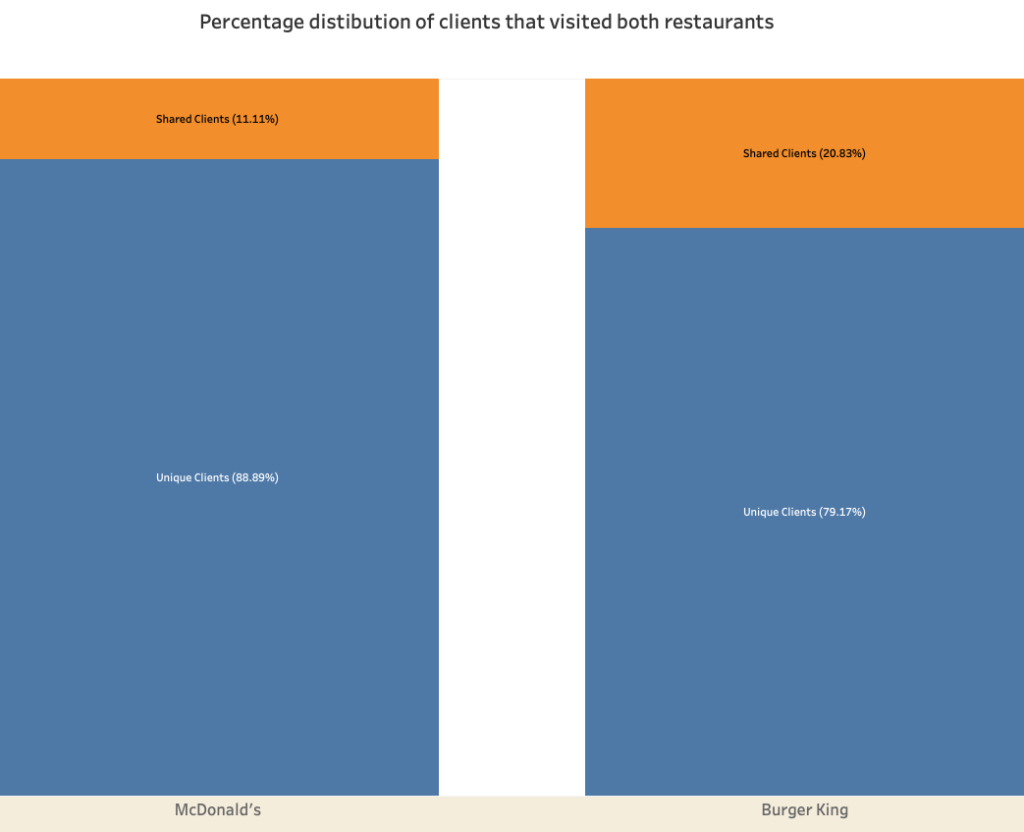

Competitor analysis

Bringing these tools together, it is possible to perform a real estate competitor analysis by geolocating and tracking competitor locations to get a relative idea of consumer foot traffic patterns and loyalty levels.

In conclusion, these tools improve the understanding of business and demographic data. In this way, investors can identify a real estate investment opportunity well in advance and ensure that their investment decisions deliver maximum value.

At PREDIK Data-Driven we generate real estate intelligence solutions to maximize your financial value by implementing location-based strategies.