Alternative data is a simple concept that provides valuable and flexible information beyond that offered by traditional data, mostly used in the financial world to evaluate a business or investment outside the scope of traditional data sources.

The accelerating generation of alternative data obtained through emails, social media, satellites, financial reports, geolocation, among other sources, has introduced a great new opportunity to improve profits in the marketplace.

Alternative data can include any type of data, but one type that is increasingly being used is geospatial data. This stems from the fact that it is important for investment firms understand the geospatial components of consumer behavior, as well as the insights they can provide.

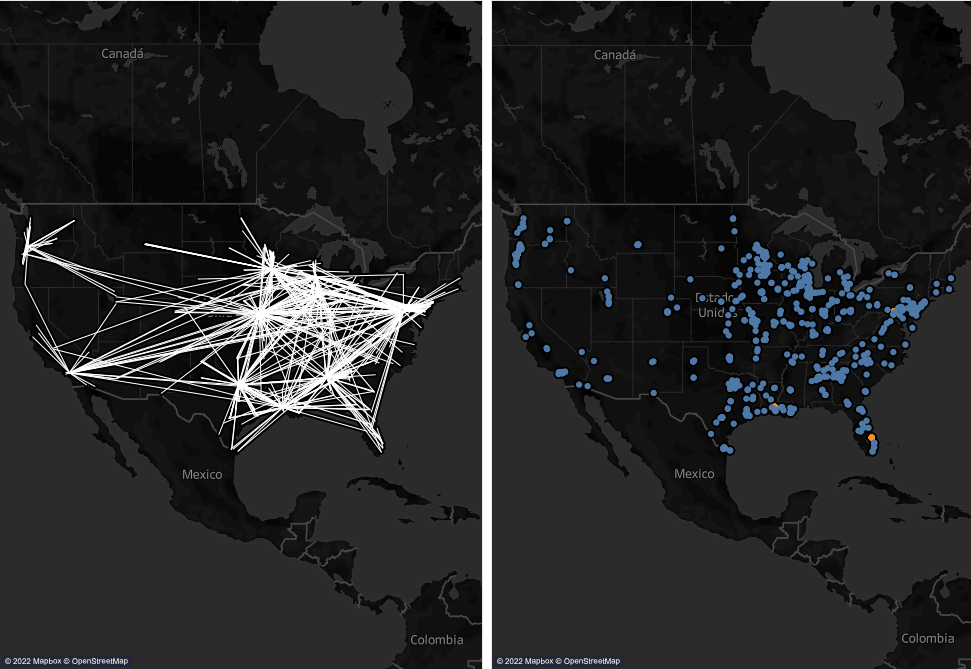

Also Read: “Supply Chain analytics and inter-company relationships”

Why is it so useful?

Alternative data has been widely embraced by companies looking to improve predictive rates, maximize returns and decrease unforeseen risks. In addition, this new source of data provides certainty, offering companies more than just Big data.

With alternative data, it’s easy to understand the external factors that influence companies. Then, companies can use the information to stimulate better decisions that bring more profit and success .

What happens when we combine it with predictive analytics?

The correct use of alternative data through machine learning offers companies a fascinating advantage; access to valuable information about future customer and market behavior, enabling companies to grow rapidly and gain a noticeable competitive advantage.

Main problems that can be solved with alternative data

Poor decision making: Helps make better, informed decisions with complete and accurate data on consumer profiles, detecting variations in individual preferences in order to build a complete picture of consumer needs in your industry.

Null predictive modeling: Helps to take into account many different variables that could affect this change, such as supply of goods/materials, consumer demand and economic trends, can also reveal possible future events and premature signals of financial problems. You can also use them to identify past business trends that are likely to be repeated in the future.

Non-concrete database: Provides a complete portrait of consumers’ needs, behaviors and preferences to align plans with their interests.

Null Accessibility: Helps prevent data decay (data decay occurs when the data sets being collected are no longer relevant to current industry events).

Non-processable intelligence: Provides a wealth of fresh data that could be used immediately to solve problems and predict financial stability.

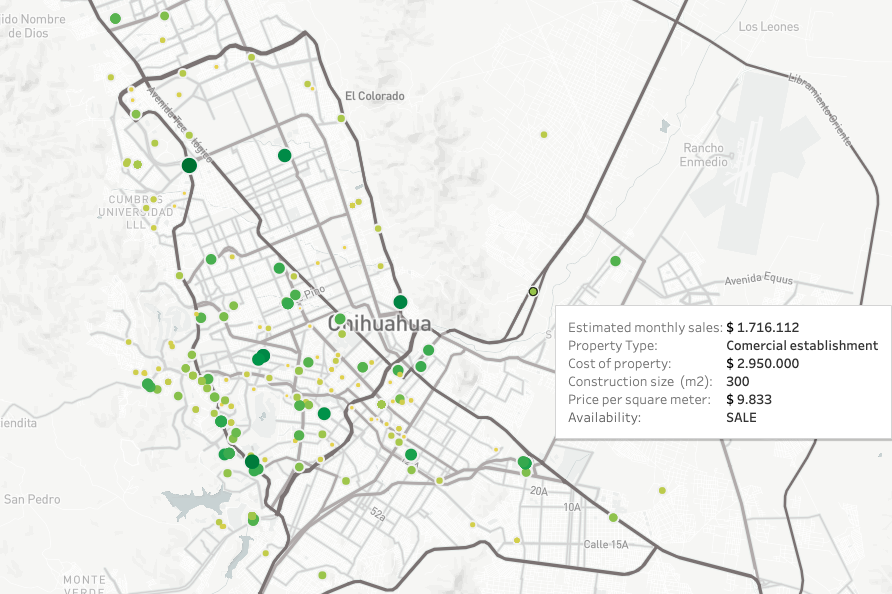

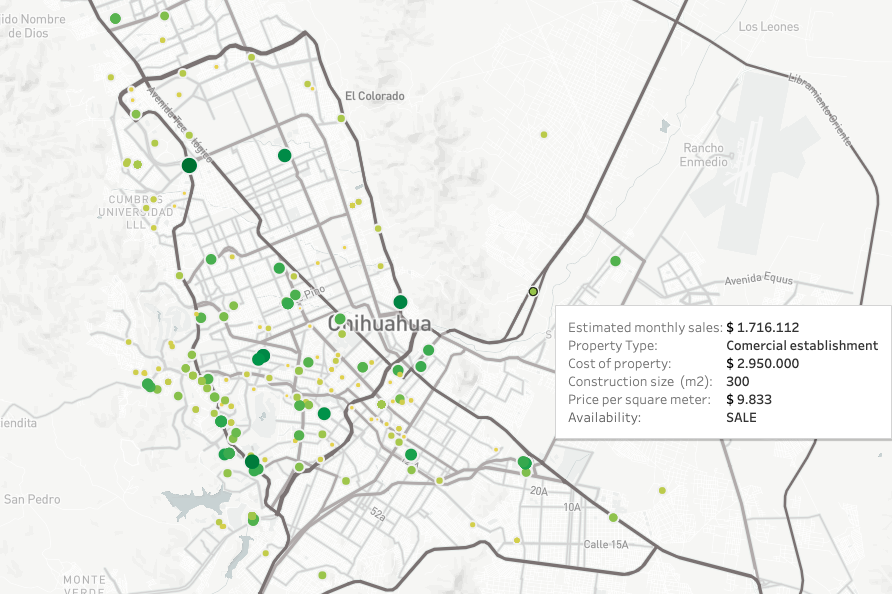

Little investment research and deal sourcing: Enable enriching financial analyses with data on points of interest, ownership and mobility to see how consumers interact with stores in specific locations. All of these factors can indicate whether or not a potential investment is worth serious consideration.

Undue diligences: Allow analysts to uncover unforeseen anomalies that indicate an investment has more risk than its potential returns justify.

Poor portfolio management: Helps to monitor the changing dynamics related to each business or asset, and thus help companies make decisions about whether or not to hold specific investments.

No insight into inter-company relationships: Allows to indicate possible future partnerships, mergers or acquisitions.

In conclusion, alternative data allows investors and analysts to look at companies and assets through various scenarios. This can allow them to anticipate market trends before they occur, or to see investment opportunities or pitfalls that they would not be able to see if they only used traditional financial data.

You might be interested in: “Which type of alternative data is beneficial for investors?”

At PREDIK Data-Driven we use POI and foot traffic data, and enrich it with different types of alternative data, in order to generate solutions based on accurate information and maximize the profitability of any type of business.

Request more information to get the full picture of this solution