Alternative data refers to unconventional, non-traditional data sources that provide strategic insights. Unlike traditional sources, it uncovers hidden trends and patterns often missed by standard data analysis.

How has alternative data transformed business intelligence?

Historically, businesses and hedge funds used only traditional data to make decisions. However, the last decade has seen an exciting shift towards alternative data. Companies realize that having unique, timely, and granular information provides a significant competitive edge in a rapidly evolving market.

In this article we will cover:

Types of Alternative Data: Traditional Vs. Alternative

Alternative data sets contain an extensive display of information types. They range from foot and web traffic to credit and debit card transactions, social media data, supply chain data, and even weather data. This contrasts with traditional data sources, which tend to be limited.

| Criteria | Alternative Data | Traditional Data |

|---|---|---|

| Definition | Data from unconventional and non-traditional sources that provides additional insights. | Data from conventional and established sources used in business and investment decision-making. |

| Sources | Web traffic, social media sentiment, satellite imagery, credit and debit card transactions, IoT data, geolocation data, customer reviews & ratings, data providers, etc. | Financial reports, SEC filings, market research data, press releases, etc. |

| Format | Often unstructured, requiring sophisticated processing and analysis. | Mostly structured, easily interpreted and analyzed with traditional data analysis tools. |

| Speed | Often real-time or near-real-time, enabling quick decision-making. | Usually not real-time; may have time lags due to reporting cycles. |

| Insights | Provides unique, granular, and sometimes predictive insights. | Provides standard, necessary insights, often lagging indicators. |

| Use | Used to gain a competitive edge, uncover hidden patterns, and predict future trends. | Used for regular business operations, compliance, and standard reporting. |

| Access | Can be challenging to access due to privacy laws, need for specialized tools, and complex data procurement methods. | Readily available from company reports, regulatory bodies, market research firms, etc. |

| Legal and Ethical Considerations | Requires careful attention to privacy laws, data rights, and ethical implications. | Widely accepted and regulated, with clear legal and ethical guidelines. |

It’s important to note that alternative data does not intent to replace traditional raw data. Instead, it complements standard data, providing a more holistic, comprehensive view of the market landscape and consumer behaviors.

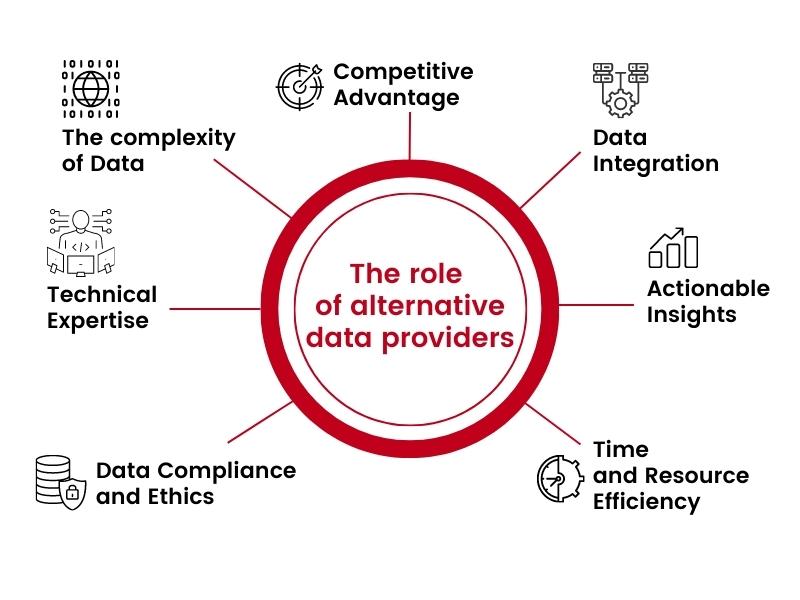

The role of alternative data providers

Getting the most out of this data is not easy. For most companies having an external data expert team will be necessary. Why? Heres are some reasons:

The complexity of Data. As we already explained, non-traditional data is often unstructured and comes from various sources. It requires specialized skills to clean, process, normalize, and analyze this data type.

Technical Expertise. Working with this kind of data requires a strong understanding of advanced data analytics tools and techniques. This includes knowing about Machine Learning and AI algorithms, data mining, and predictive analytics.

Considering all these requirements, only a specialized team can bring the necessary technical background.

Data Compliance and Ethics. Ensuring the ethical use of data and maintaining compliance with data privacy laws is a key consideration. Specially when working with non-traditional data.

Only data experts who understand the legal landscape can help mitigate any potential risks.

Data Integration. To get the best out of alt data, it must effectively integrate with traditional data sources. A team skilled in data management can seamlessly blend data from various sources, providing a more holistic view of business insights.

Actionable Insights. The ultimate goal of using non-traditional data is to gain unique, actionable insights that drive business decisions. Data experts can interpret complex data sets and translate them into understandable and usable business insights.

Time and Resource Efficiency. Collecting, cleaning, and analyzing data can be time-consuming and resource-intensive.

A team of data experts can perform these tasks more efficiently, allowing the business to focus on its core functions.

Competitive Advantage. The most compelling reason is the competitive advantage that a skilled data team can provide.

Their ability to mine deep insights from alternative data can traduce to strategies that set the business apart in the marketplace.

Are you looking for a specialized alternative data solution provider? At PREDIK Data-Driven, we have more than 14 years of experience helping companies worldwide solve all kinds of business problems through personalized alternative data solutions. Let’s talk business

How to Choose Alternative Data Company Providers?

Choosing the right alternative data providers is key. Data accuracy, relevancy, and timeliness must be taken into account when using an alternative data provider. Additionally, compliance with ethical standards and privacy laws should be considered.

The chosen company should deliver customized solutions that align with your unique requirements.

The Benefits and Impact of Alternative Data Analysis Across Industries

Alternative data research is reshaping various industries, driving innovation, and providing significant competitive advantages. Let’s explore the impact and benefits of alternative data in some key sectors:

Alternative Data for Financial Services, Banking, and Fintech

The rise of alternative data has helped banks and financial institutions navigate complex scenarios more effectively. This has offer new ways to understand their customers and markets to make better investment decisions.

We recommend you reading: Big Data in Banking Industry: How to overcome new challenges

Deepening Existing Customer Relationships. Traditional data might show us what customers buy but rarely reveals why. Alternative data enables financial institutions to peel back the layers, providing a multidimensional understanding of their customers.

This data could spotlight a customer’s rising income, changes in marital status, or increased community involvement. All helpful information when tailoring offers to meet evolving needs.

Pinpointing the Right Prospects. While traditional data gives a base prospect understanding, non-traditional data (Like address history and court records) provide a more comprehensive and personal view.

Risk Assessment for Small Business Portfolios: Small businesses are a goldmine of opportunity for financial institutions. Yet, they often lack the borrowing history necessary for traditional risk assessment.

Alternative data can bridge this gap, giving a detailed insight into the business’s performance and potential (Regardless of its borrowing history).

Unveiling new customer opportunities: Traditional credit examinations often overlook individuals with limited credit history.

Alternative data can bring these individuals into focus. The result: Banks can reveal modern credit-seeking behaviors and life event insights such as professional licenses and asset ownership.

When combined with advanced analytic models, alternative data can provide a more accurate creditworthiness assessment, helping institutions reach a larger audience.

Leveraging Alternative Data in Retail

With an increasing volume of digital touchpoints, retailers are turning to alternative data for better insights and decision-making processes.

Predicting Customer Behavior. Alternative data, including social media behavior, online reviews, and web browsing history, provides valuable insights into customer preferences and buying habits.

Retailers use this information to predict future purchasing behavior. This enables them to customize their marketing strategies to maximize customer engagement and sales.

For instance, by analyzing alternative data, a retailer may identify a rising interest in sustainable products. Then, increase the promotion of their eco-friendly line.

Acquiring New Customers: Retailers can identify potential new customers through alternative data sources. This targeted approach can significantly enhance customer acquisition by enabling companies to direct their marketing campaigns toward those most likely to convert.

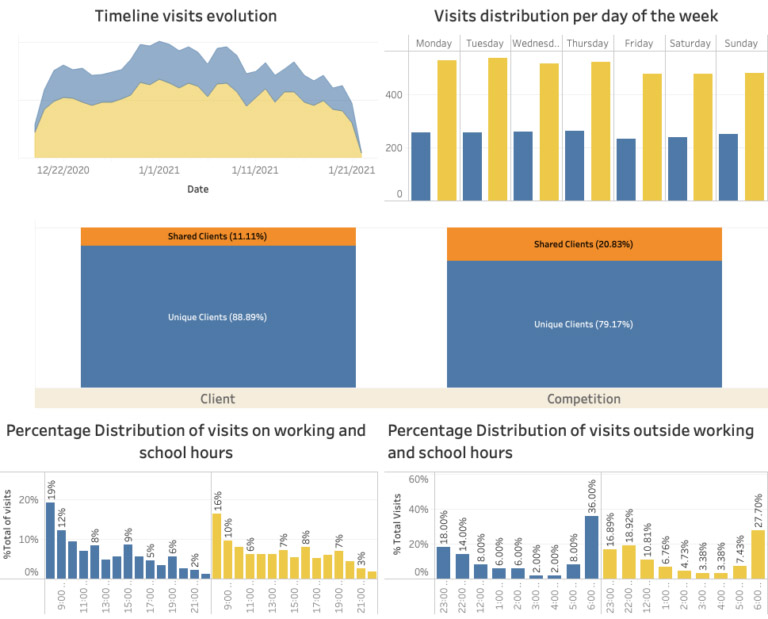

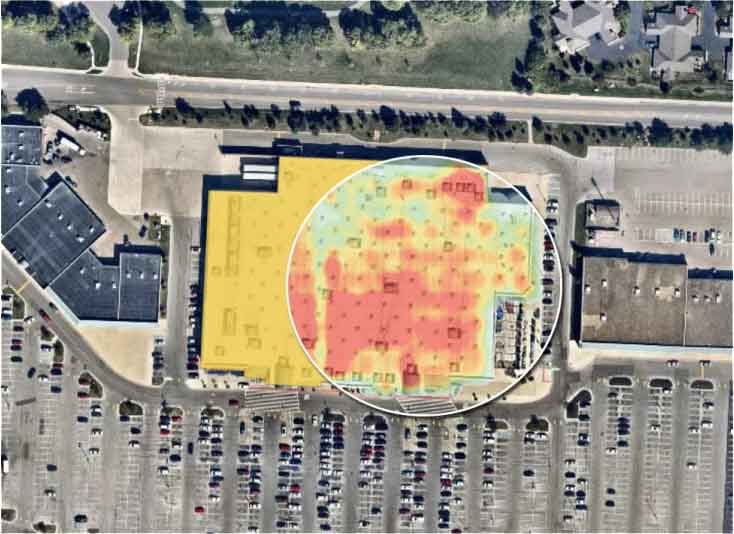

Store Optimization: Retailers can use geospatial data, including foot traffic and demographics of a specific area, to determine optimal store locations.

This data helps retailers understand where opening a new store would be most profitable.

Predicting Sales: Thanks to alternative data, sales prediction has never been more precise. Retailers can use historical sales data combined with external factors like seasonality, holidays, and economic indicators to forecast future sales accurately.

This information is crucial in inventory management, minimizing the possibility of stockouts or overstocks.

Improving distribution: Supply chain optimization is another area where alternative data can make a significant difference.

Retailers can optimize delivery routes, minimize transportation costs, and ensure timely delivery. All of these by analyzing data sets from IoT devices in warehouses, weather forecasts, and traffic patterns.

The role of Alternative Data for Real Estate

Alternative data improves the real estate industry by providing granular, market-specific insights that enhance decision-making and forecasting.

Specialized Real Estate tools can use various data points to understand local dynamics, refine traditional forecasting models, and generate diverse outcome scenarios.

Innovative uses of alternative data, like streamlining operational aspects of real estate investments, are emerging, enabling even smaller investment managers to scale effectively.

Benefits of using alternative data in real estate:

- It provides market-specific insights rather than broad averages.

- It allows a better understanding of local dynamics, including safety perceptions, education quality, regional employment growth, and consumption patterns.

- It enables more nuanced analyses of macroeconomic influences.

- With Machine Learning and Big Data techniques, it refines traditional forecasting models and generates many potential outcomes.

- Innovative uses are emerging that streamline real estate investments’ operational aspects and reduce costs.

- It promotes data-driven decision-making, which is crucial in the volatile capital market environment.

We recommend you reading: Real Estate Data Analytics: A Guide for Decision-Makers

Alternative Data in Logistics

The logistics sector increasingly turns to alternative data to maintain supply chain robustness and responsiveness. Especially in the wake of significant disruptions such as the COVID-19 pandemic.

Learn more about: Supply Chain Mapping Tools

Traditional models of “just in time” and “lean” management, while efficient, can be susceptible to unexpected events. That is why businesses seek resilient strategies.

In this scenario, the use of alternative data is advantageous for several reasons:

Timeliness. Traditional data sources often lag 30 to 90 days. In a fast-paced business environment, this delay can be harmful.

Alternative data, however, can provide insights based on the most recent information.

Macroeconomic Considerations. Alternative data can help businesses account for broader macroeconomic factors that could impact their operations.

Challenging Assumptions. Using alternative data encourages businesses to question traditional assumptions and consider different approaches.

Forecasting: Just as financial managers use alternative data to predict market trends, logistics companies can leverage alternative data for forecasting in freight and transportation.

The Future of Alternative Data Research: Trends and Predictions

The global alternative data market size expects a compound annual growth rate (CAGR) of 56% by 2027 (Predominantly led by North America). AI and Machine Learning integration with alternative data are emerging trends.

With its diversity and comprehensive insights, Alt data is proving to be a valuable tool across different markets. Depending on the industry, companies can predict consumer behavior, optimize business locations, improve patient care, and strengthen supply chain robustness.

The value of alternative data lies in its ability to provide timely, refined, and often unique insights. Insights that traditional data sources may miss.

As technology advances and alternative data collection improves, businesses will increase their competitive edge.

In the face of rising market volatility and quick changes in consumer behavior, using alternative data is not just an advantage—it’s becoming a business must.