Success stories > ATMs

How a financial company has managed to successfully expand its ATM network

Company

Challenge

Solution

Results

Full understanding about the key points to consider when placing an ATM.

Our client

Through a specialized team of engineers, bankers, and experts in payment methods and tourism, the company has placed over 170 ATMs in strategic touristic cities.

Big Data has become essential in the banking and financial field. Beyond its use in numerical analysis, it also performs as a pillar for successful strategies within sales, marketing, and expansion departments.

The challenge

Identify areas with a high flow of foreign tourists to place new ATMs.

A major benefit of this ATM network over others is the more favorable exchange rate offered to tourists. This feature has led to growing demand for its ATMs, especially in tourist areas and among foreign visitors.

The company aimed to strategically meet the demand of the tourist market by identifying areas with the highest influx of visitors to install new ATMs.

Solution

We developed a predictive model using machine learning and AI to identify key points for placing ATMs.

We analyzed the top tourist destinations in the targeted country to develop a predictive model. Our research involved gathering data from portals like Airbnb and VRBO, focusing on details like the average price per room. Additionally, we incorporated data from traditional hotels to ensure comprehensive market coverage.

Also, we gathered information on restaurants, entertainment, traffic, pedestrian flow, and competition from ATMs in the area.

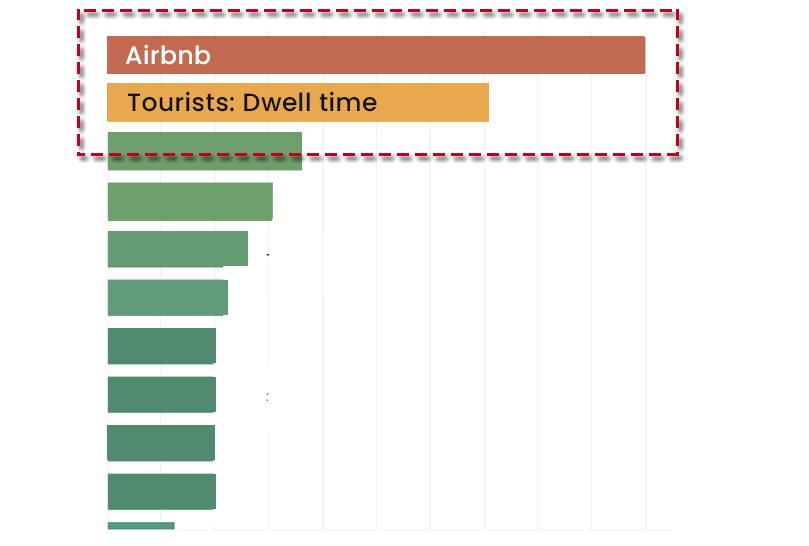

The model indicated that the presence of Airbnb and the length of stay of tourists were the two most crucial factors when evaluating a location.

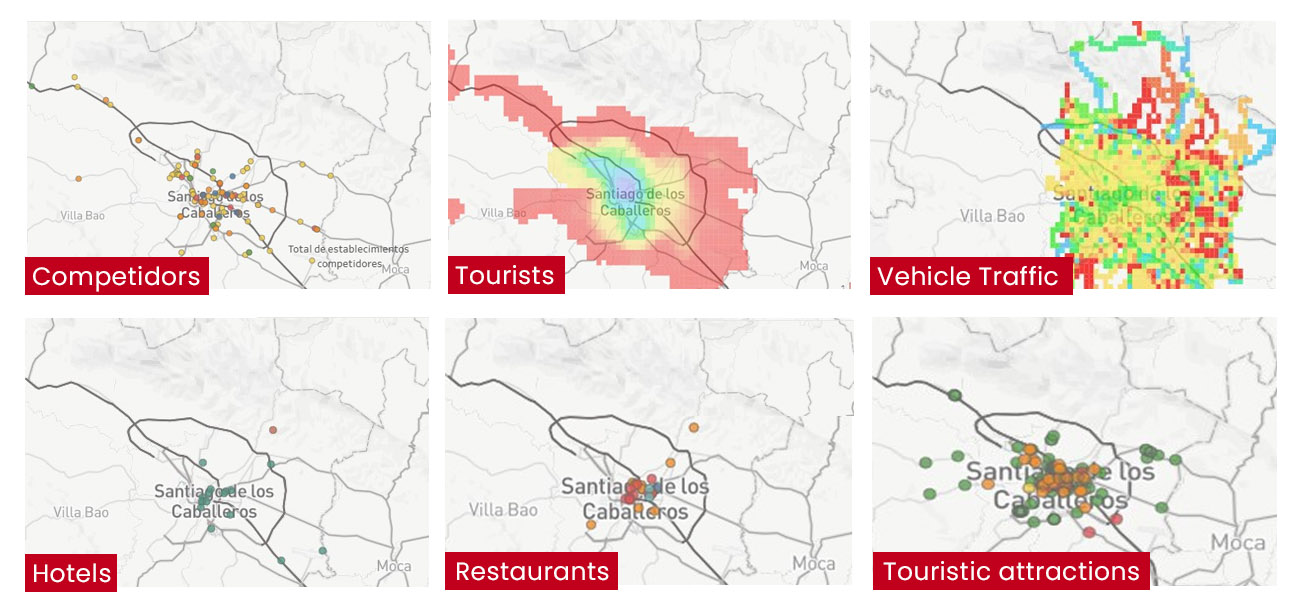

The maps shows the analysis of the different variables. For instance, the “tourist concentration” image was created using mobility data to identify the areas with the highest concentration of foreign tourists (represented by blue and green colors). This analysis was conducted for all cities in the targeted country.

After obtaining the required data, we aligned it with the client’s ATM behavior. Our goal was to identify the factors that led to increased dollar transactions at certain ATMs. For this purpose, we used a year’s worth of weekly transactional data.

With this information, the predictive model was able to identify the specific features that led to high performance in ATM locations. Furthermore, the model could predict the number and amount of transactions an ATM could receive based on the “training” data in a particular area.

The image shows how heat maps were created to analyze the mobility of tourists (Red areas indicate higher mobility).

“The team was fantastic and we are truly pleased with the results. 100% would recommend and work again with.

We wanted to analyze tourists’ movements in order to find new locations. PREDIK Data-Driven provided us with a quality model that suggested us the right locations taking in account multiple factors.”

Results

Location of strategic points to place ATMs in tourist sites.

Until now, our client is still using our model to detect unserved locations with a high potential for success.

Find out what Big Data Analytics can do for your company

Schedule a 30-minute meeting with one of our data experts to understand how can we work together and develop the perfect Big Data solutions for your organization.

Our solutions have helped some of the most important corporations in the US, Europe, Latin America, and Asia Pacific.