Knowing your competitors is crucial to staying ahead in the market. Competitive data contains all relevant information about your competition, including their products, services, pricing, marketing strategies, and operations.

In this article we will cover:

The way companies collect and use data has changed

Gathering information about competitors and using it to gain a market advantage and enhance brand value is an age-old strategy. However, the process was slow, limited in scope, and challenging to scale.

Acquiring valuable insights from all competitors required analyzing sales data, conducting customer surveys, and conducting mystery shopping. What was the issue? Traditional research methodologies were time-consuming, prone to biases, and quickly outdated.

This scenario dramatically changed with the rise of Big Data and new technologies based on Artificial Intelligence and Machine Learning. Recent analytics advancements have enabled organizations to process and interpret vast amounts of data more quickly and precisely.

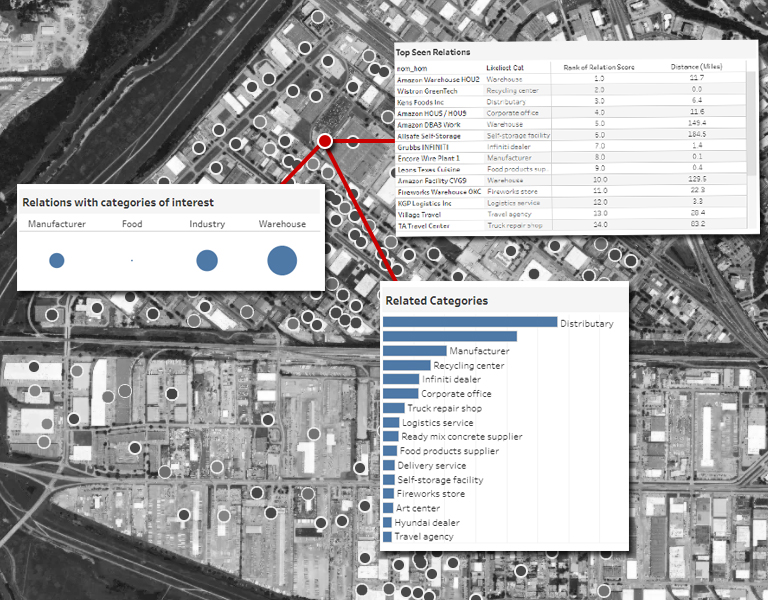

For instance, geomarketing, alternative data, foot traffic data, and satellite imagery allow companies to analyze their competitors in ways that were impossible decades ago. Overall, having more information sources and tools enables data-driven approaches to be much more powerful than the insights companies produced in the past.

Why use competitive data?

By having high-quality competitor insights, your organization can identify its strengths and weaknesses, which will help you take advantage of market trends and opportunities more effectively.

“Only 39.3% of companies are managing data as a business asset”

New Vantage report

We recommend you reading: Is Your Company Data-Driven? (Let’s Find Out)

Uncover hidden and non-obvious opportunities

One of the biggest challenges of any marketing, sales, and intelligence department is to find any opportunity that can lead to growth or expansion over the competition.

But where to focus attention? On their pricing strategies? Product development? POS expansion? This decision gets even more difficult in complex markets.

That is why having robust competitor data can help decision-makers simplify their analysis process and identify the trends and opportunities that no one is paying attention to.

Better market intelligence

Where is your company positioned against the competition? What is your actual market share? What is your sales potential within specific markets and territories vs. the others? How are your physical POS performing in comparison with your top competitors?

Having the correct competitor data can help you answer key market questions.

We recommend you our guide: Master Competitive Tracking: Tips & Tools To Beat Your Competitors

Develop better products

Which features do consumers value the most from your competitors’ product catalogs? A combination of competitor and consumer data can bring a clearer vision.

You will also find useful: The Best Way to Do Market Research for a New Product Development

Identify new players

The more competitor data you have, the better your organization will monitor possible threats from old and new competitors (Direct and indirect).

What are the best sources to get dedicated competitor data?

Usually, companies get insights from the competition by receiving feedback from clients and leads, as well as by looking at public financial statements, news related to the industry, and information posted on websites and social media.

That is a good start. But, to have an accurate competitor analysis, it is necessary to start using other sources of information.

For example, alternative data like social media sentiment, mobility patterns, customer reviews, credit and debit card transactions, and web scrapping can provide you with unique and granular insights.

Elements to consider

Although using external sources can be a game-changer for your organization, it’s important to consider certain factors:

- First and foremost, it’s crucial to ensure that any data you collect fully complies with all relevant privacy laws and regulations.

- Additionally, it’s important to prioritize data quality over sheer quantity.

- Finally, be sure to choose sources that align closely with your company’s overall objectives and goals.

Where to start?

To start getting the best of competitor data, we recommend you follow these three steps:

Step 1: Define your data needs.

Step 2: Define your data sources and methodologies.

Step 3: Establish how data is going to be analyzed.

Step 1: Define your data needs

First, define the specific competitive insights you need. For example, maybe you want to focus on how your top competitors are expanding in certain territories. Perhaps you want to track how new competitors are pricing their products to get into your target market.

Make a list of specific insights so data extraction can be more manageable.

Step 2: Define your data sources and methodologies

Remember, it is not only about data quantity but also quality.

For that, you must select the best combination of internal, external (traditional), primary, and alternative data.

Once you have identified a suitable set of data sources, the next stage is to define the methodologies that will help you get the best of the collected data.

Step 3: Establish how data is going to be analyzed

Consider this: The more sources and data types you use, the more difficult it will be to process and integrate it. That is why, you need to contemplate the best tools for the task (Machine Learning, AI solutions, NLP).

Use competitive intelligence data for strategic decisions

At PREDIK Data-Driven, we are experts in collecting, processing and analyzing competitive intelligence according to your business requirements and objectives.

Our specialized solutions bring you high-value insights that no other competitor can get. And the best part? We take care of all the “technical” work so you can focus on making the best decisions.