By 2024, 70% of retail transactions will occur in physical stores, according to Forrester. This means that despite the growth of e-commerce, the importance of having a good physical location will remain relevant for retailers and brick-and-mortar brands. In other words, the “location, location, location” mantra will still be applicable.

In this article we will cover the following topics:

The era of “modern” retail site selection?

Selecting a retail site involves the process of identifying and assessing potential locations for a physical store. It is an essential strategic decision that significantly affects a business’s performance, profitability, and overall brand image. Unlike when decisions were based on intuition, modern site selection uses data-driven models and comprehensive analyses to ensure the selection of locations that maximize success.

The importance of having a solid site selection strategy

As you know, business location can impact the amount of organic foot traffic a store gets. Also, a correct location significantly influences a brand’s visibility and ability to attract new shoppers.

That is why a well-implemented site selection strategy can differentiate between the performance of successful and failing physical stores.

If a potential customer can’t find you easily, they will go elsewhere. If they can’t park nearby, they will go where the parking is easier.

Retail Gazette

Common mistakes organizations make when developing a retail site selection strategy

Finding the “perfect” location for a new POS is an old-time problem for decision-makers and organizations. Developing a good site selection strategy is not an easy task as it involves careful analysis of factors such as market dynamics, competitor presence, accessibility, infrastructure characteristics, and real estate options.

The decision-making process becomes more complex as the factors involved increase. However, relying solely on intuition and experience without proper data analysis to support crucial decisions can result in flawed strategies. Mistakes during any process step can lead to risks, costly delays, and even fatal errors. After all, approaching the site selection process with caution, expertise, and solid information is essential.

According to Deloitte, some of the most common mistakes involving a site selection process are:

Incorrect search area

Selecting a site for a new facility typically starts with a broad area of interest, influenced by foot traffic, socioeconomic elements, user behavior, and other market dynamics. However, it is crucial to carefully assess this geography against the new facility’s overall operating goals and requirements. Otherwise, issues may arise, and valuable time may be wasted.

Narrow a search area to save time

Once the search area is identified, companies often rush to exclude large regions to speed up the process. However, this hasty approach may eliminate entire counties or states that could have been viable options with proper analysis. It is essential to prioritize the critical location factors of the project – those aspects that can be measured and quantified – and make decisions based on these factors.

Failure to consider all the critical elements

Every location search has unique critical factors, specifications, needs, timing, and risks. Thinking only of easily quantifiable aspects such as labor costs, real estate, or taxes during site selection is a mistake.

Failure to consider key trends within an area’s community

Every location is constantly evolving, and this can have a significant impact on businesses that operate there. Factors like demographics, property values, and public perception can change frequently. Keeping a constant area monitoring can help keep track of the full context and dynamics of a location.

Deficient or absent technical site review

Projects often face unexpected challenges. Therefore, assessing environmental risks, timing, development obstacles, and construction costs that vary geographically is crucial.

How is Big Data changing site selection processes?

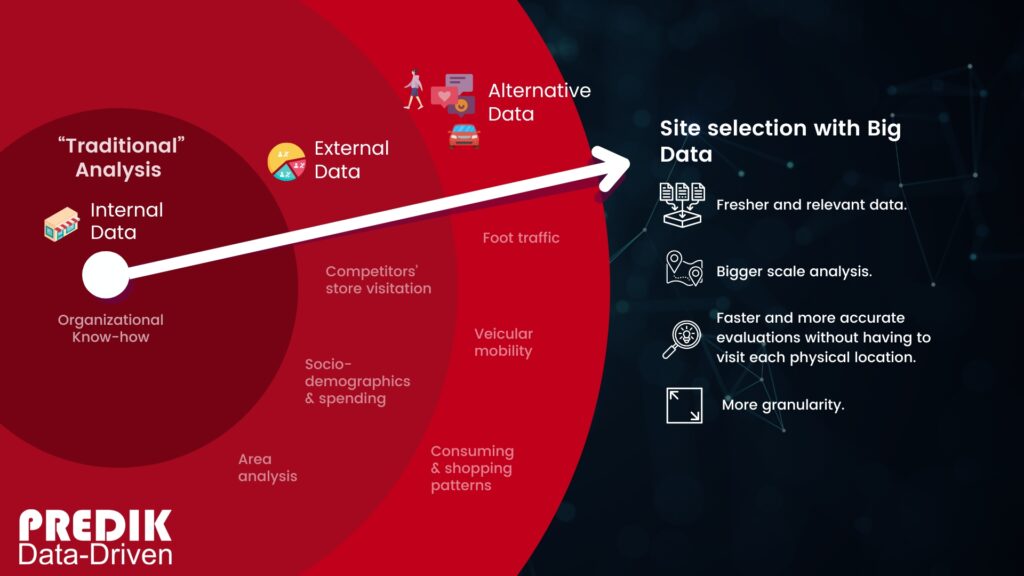

“Traditional” site selection methodologies often rely on internal data, inside market knowledge, and try-and-failure experience. Now, in the era of Big Data, there is a better and more accessible synergy between internal data, external data (competitor’s visitation, census data, sociodemographic info, area activity analysis), and alternative data (foot traffic patterns, mobility data, spending behavior, shopping preferences, vehicular flow).

Some of the pros of using Big Data for site selection strategies are:

- Fresher and relevant data from a vast volume of sources can provide a broader and more reliable market understanding.

- Big Data methodologies allow decision-makers to analyze bigger, more complex areas remotely and faster.

- Using better data analysis methodologies provides more insight granularity at a point where analysts can understand which street is better for a new opening store.

Another point in favor of using Big Data methodologies is their adaptability. Not all brands follow the same approach, which is why companies can get tailor-made data analytics solutions according to their specific needs.

Understanding your current physical stores performance

The first step to developing a successful site selection strategy is to evaluate current store performance.

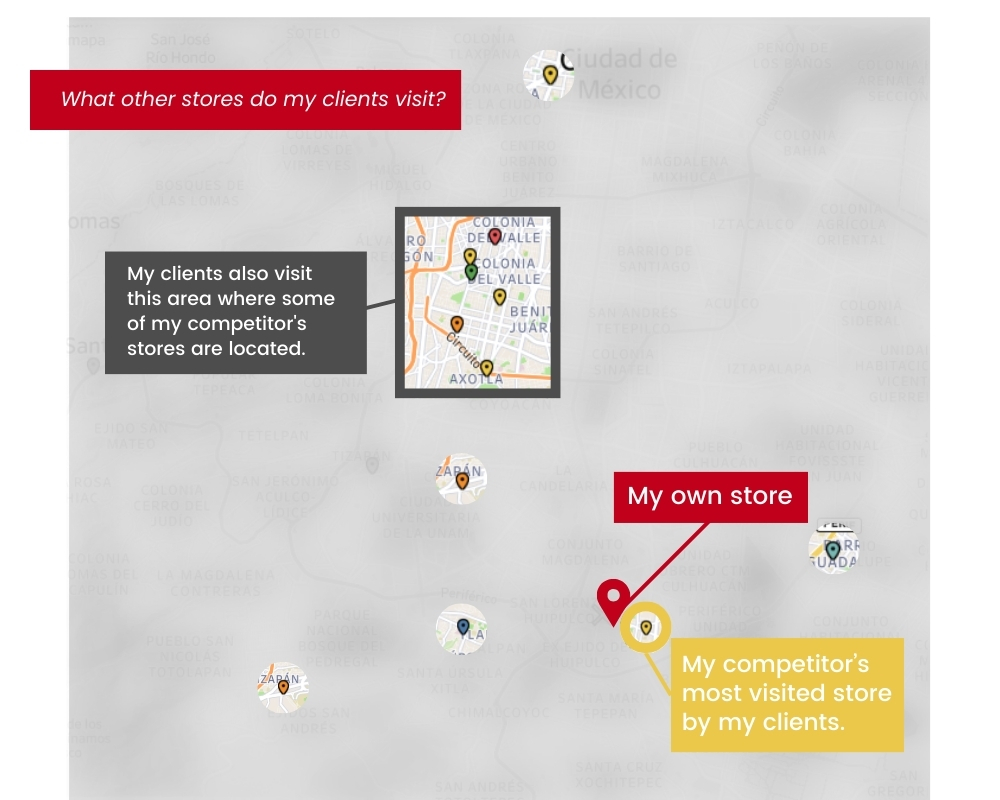

Using site selection solutions based on Big Data and Machine Learning can help you understand the critical elements your overperforming locations have in common (For example, maybe your most successful stores are located in areas where certain brands are located). You can also analyze your competitor’s location performance for better insights.

With these insights, you can answer questions like:

- What other stores does my client visit?

- How is my competitors’ influence in certain areas? How are other brands affecting my current stores?

- What areas is my brand not covering that my competition is?

Understanding your target user behavior

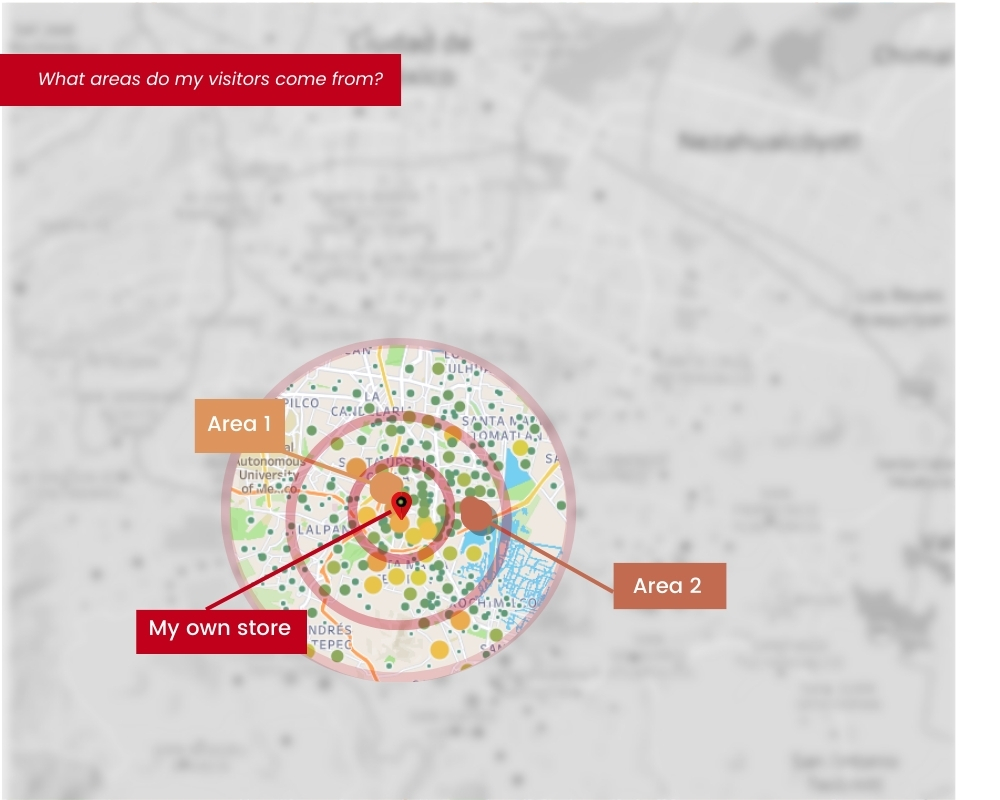

Site selection solutions that rely on Big Data use demographic information to gain insights into the characteristics of people who live or visit a particular area (Including their age, gender, income, race, education level, and more). Businesses then use this data to identify potential markets with similar demographics and tailor their customer experience strategies accordingly.

By leveraging this information, companies can effectively market their products and services and decide on the most suitable type of store for a given location (A big-box store vs. a specialty store, for example).

With these insights, you can answer questions like:

- What areas do visitors to my stores come from?

- What are the users’ preferences in certain areas? Do they prefer brands similar to yours?

- Which areas have more potential customers? Does my brand cover those areas?

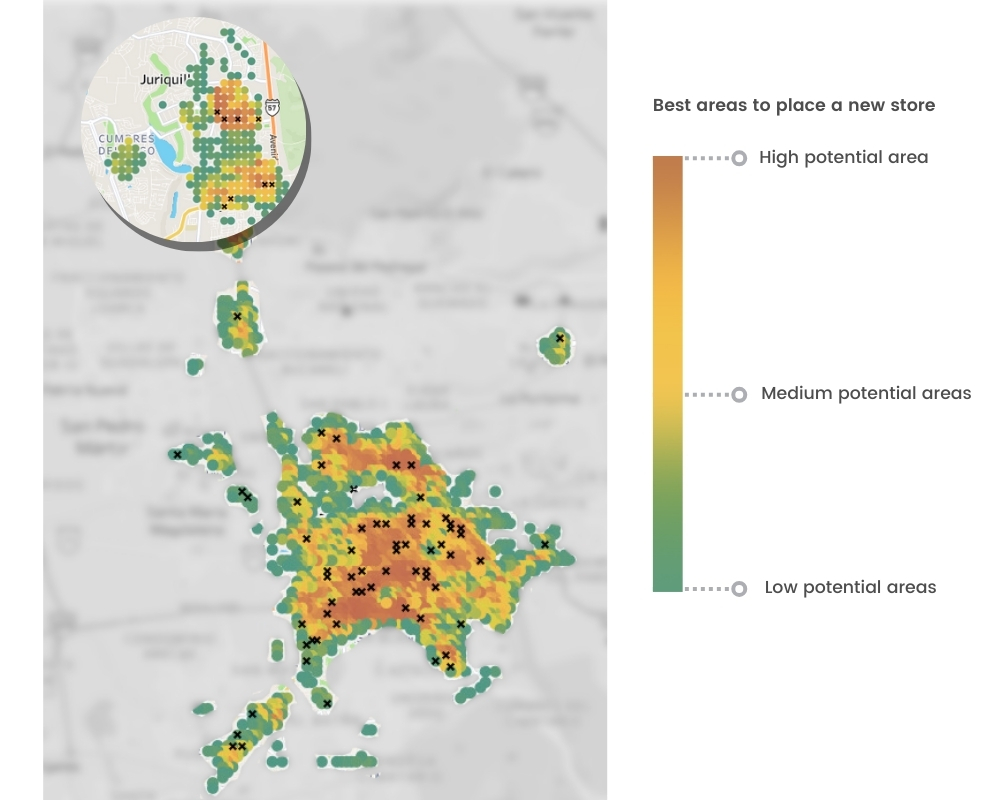

Finding “lookalike” locations using Machine Learning

Once you have identified the key elements that define the success or failure of your current stores and determined areas where potential customers are located, Machine Learning expansion models can use this information to identify new locations with high potential in areas and demographics you have not explored yet.

For instance, if all your stores are on the East Coast and want to expand to the West Coast, you can predict your regional or national expansion potential and the expected results. Then, you can use the successful location as a model for other locations you may want to set up. This will give you an idea of how your business can perform in new areas or with new demographics.

Estimate demand potential in your target site locations

You have spotted locations with success potential in uncovered areas, then what? Suppose you have competitors or similar retailers around the location you are targeting. In that case, you can use foot traffic and visitation data to see how well they perform.

For example, guess they have high visit numbers and receive users similar to your target market. In that case, there is a strong demand for your products or services in that region. You can also analyze customer journey data to understand how willing customers are to visit multiple retailers with similar offerings.

On the other hand, if there are many similar retailers with low visitor performance, it might be a sign of a saturated market. However, suppose all factors make the region appear promising but do not identify any competitors. In that case, you may have located whitespace in the market.