Risk management has become increasingly important in today’s rapidly changing business landscape; however, many companies face significant challenges like:

- The increasing complexity of risk scenarios: Companies face an increasingly complex range of risks, including cyber, operational, and regulatory risks that are interconnected and difficult to manage.

- Lack of data and analytics: Many companies lack the data and analytics capabilities to make informed decisions about risk management, potentially resulting in overestimation or underestimation of risks and serious consequences.

- The siloed approach to risk management: Risk management is often siloed within different departments, such as finance, IT, and operations. This can make it challenging to get a holistic view of the company’s risk profile and to develop coordinated risk mitigation strategies.

“64% of risk managers say that the complexity of risks has increased in the past year.”

Deloitte

We recommend you reading: Big Data for Effective Supply Risk Assessment

Using predictive analytics can assist companies in overcoming different challenges and enhance their risk management practices. By implementing predictive analytics models, companies can identify and assess potential risks more accurately, develop and implement effective strategies to mitigate those risks, and ultimately make better decisions overall.

In this article we will cover the following topics:

- What is predictive analytics risk management?

- Benefits of using predictive analytics for risk management

- Which predictive model should you use?

- How are companies using predictive analytics to manage risk? (Examples)

- What are the steps to start using predictive analytics for risk management?

- Let’s get started

What is predictive analytics risk management?

Predictive analytics risk management uses internal, external, and alternative data to identify, assess, and mitigate risks. Predictive models also use historical data to identify patterns and trends and then use it to predict future outcomes.

Benefits of using predictive analytics for risk management

Companies using predictive insights are getting benefits like:

Improved risk identification and assessment: Using predictive models can improve the accuracy and efficiency of identifying and assessing risks compared to traditional methods. This is due to the ability of predictive analytics to examine vast amounts of data and identify patterns and trends that would be difficult or impossible to uncover through manual methods.

“Utilizing data and analytical tools has allowed decision-making to become more controlled, but the large volume of data makes it riskier to handle.”

Medium

Earlier warning signs: Predictive data can provide early warning signs of potential risks, allowing decision-makers to take the necessary actions to prevent them before they cause any damage.

Better decision-making: Predictive insights are helpful to get a broader vision of potential outcomes.

Learn more: What is Predictive Analytics? Understanding the Basics and Beyond (With Examples)

Which predictive model should you use?

Companies can use different types of predictive models for their analysis strategy. So, which one is the best? This will depend on the company’s data needs, available data, and analysis capabilities.

Some examples of predictive models can be:

Regression models: Regression models help predict continuous variables, such as the amount of money a customer is likely to spend or the number of days a piece of equipment is expected to last.

Classification models: Classification models are used to predict categorical variables, such as whether a customer is likely to default on a loan or whether a piece of equipment is likely to fail.

Time series models: Time series models are useful to estimate future values of a variable based on its historical values. For example, this model can predict sales demand and stock prices.

Not sure which model is better for your organization? At PREDIK Data-Driven, we can guide you into implementing the right predictive strategy to get better results. Contact us for a free consultation.

How are companies using predictive analytics to manage risk? (Examples)

Financial institutions now employ predictive models to identify potential customers who might default on their loans. With this information, they are developing risk mitigation strategies, such as offering different types of loans based on the customer’s risk profile.

It is important to mention that not only the banking and financial sectors are adopting analytics for predictive purposes. Industrial companies are also using it for predictive maintenance. Additionally, logistic companies use predictive tools to prevent supply chain disruptions, insurance institutions use them to adjust their policies, and retailers use them to avoid product production issues.

Even product development departments, sales teams and marketing teams are using predictive solutions to mitigate the risks associated with launching decisions, such as the threat of the product not being successful, analyzing the impact of competition, and detecting any consumption instability in a market.

What are the steps to start using predictive analytics for risk management?

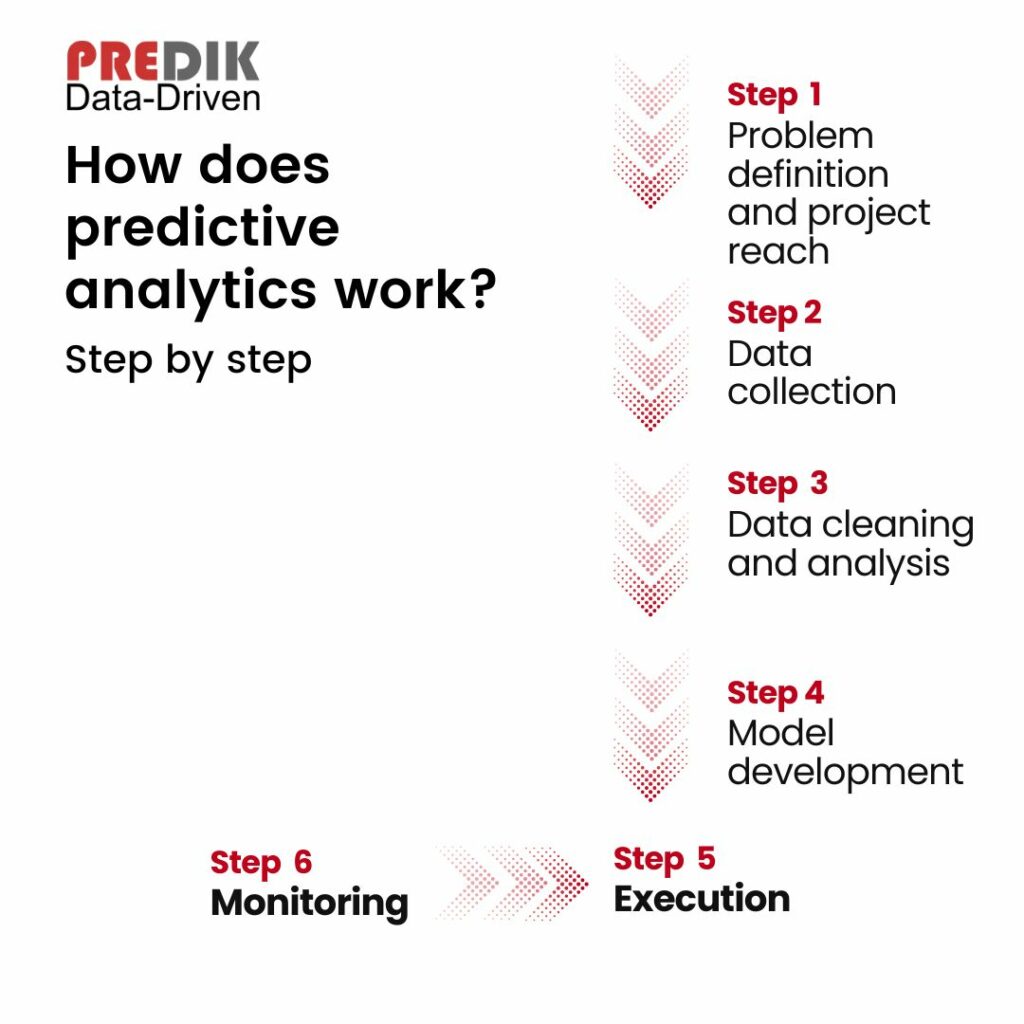

The first step consists of identifying the risk scenarios you want to monitor. Once you have determined them, your data team must collect the relevant data for those risks.

Once data has been collected, your analytics team must choose a well-suitable model for your specific needs. This model needs to train it on your data and other sources of information (For example, transactional data or foot traffic data).

Once the model is trained, there is a process of validation, monitoring, and execution.

Let’s get started

Whether you have a robust data team looking for new datasets to improve their current models or a small analytics team that needs guidance on starting from scratch, we can provide you with all you need to develop high-performing models.