Specialized Guide

Real Estate Data Analytics: A Guide for Decision-Makers

Topics covered in this guide:

- What is Real Estate Data Analytics??

- Impact of Data Analytics on Real Estate

- Real Estate Analytics Tools: The Role of Heat Maps

- Commercial vs. Residential Real Estate Data Analytics

- Case Studies of Real Estate Data Analytics

- The Future of Real Estate Analytics

- Potential Challenges and Solutions

Make smart and accurate decisions. Are you looking to get the best out of your data? We make Real Estate Analytics simpler and more precise for your particular needs and requirements.

Historically, the real estate industry has relied on a mixture of local knowledge, intuition, and traditional data sources. However, with technological advancements, data analytics has prompted a notable transformation in the sector.

Integrating Big Data and Machine Learning has changed how investors, developers, and brokers understand and interact with their market. Also, these powerful tools offer a clear window into valuable insights that inform decision-making. And if that is not enough, they can drive real estate investment and management success.

What is Real Estate Data Analytics?

Real estate data analytics is the process of examining, cleansing, transforming, and modeling raw data. This is done to discover useful information, draw conclusions, and support decision-making in the real estate sector.

Real Estate Analytics process involves collecting vast amounts of property data, such as:

- Location.

- Prices.

- Size.

- Amenities.

- Property condition.

- Local market trends.

- Demographics.

- Economic indicators.

- And more.

All this data is then analyzed using different statistical methods, algorithms, and analytical models to reveal patterns, correlations, and trends.

The obtained insights can help real estate professionals, investors, brokers, and other stakeholders make more informed decisions about:

- Property valuation.

- Investment strategies.

- Market forecasts.

- Risk assessment.

- Customer behavior patterns.

- And more.

In essence, real estate data analytics takes the guesswork out of real estate decision-making, replacing it with data-driven insights.

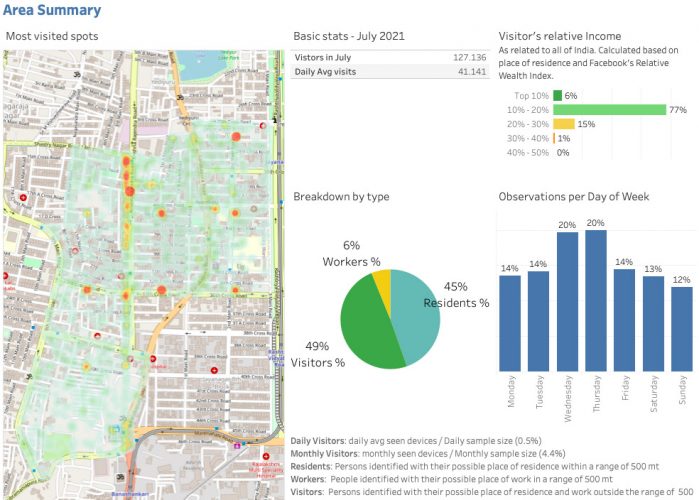

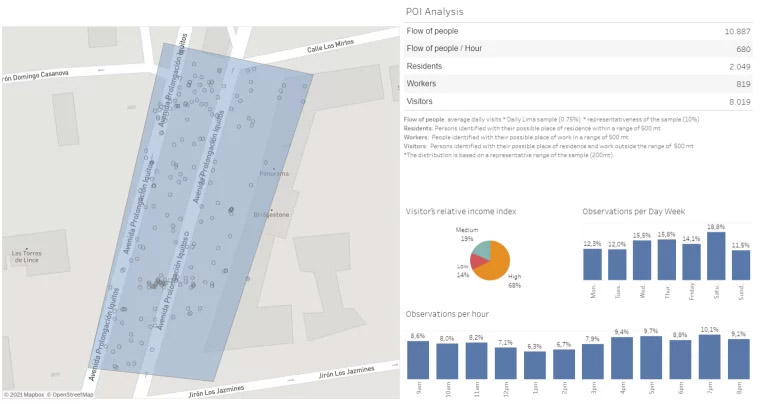

Did you know that our Real Estate Analytics tools & solutions can provide you valuable insigths? These are some examples:

- Price research by area and examination of a property’s surrounds.

- Interactive maps of the floating population, mobility, and residential and commercial real estate inventory provide comprehensive solutions.

- Studies on area appropriateness and sales forecasting models.

- Residential, commercial, and industrial markets are all segmented in this analysis.

- Inventory, sales, absorption rates, and buyer preferences are all factors to consider when evaluating purchase possibilities.

- Demand modeling based on price per m2 is used to assess feasibility.

Impact of Data Analytics on Real Estate

Data analytics profoundly impacts real estate decision-making, improving how investors, brokers, property managers, and other stakeholders operate within the industry.

Being slow to identify subtle trends means leaving money on the table. Conversely, being a first mover on a compelling (and perhaps inconspicuous) opportunity translates into significant advantage.

McKinsey

Enhancing Property Valuation with Data

A property’s value no longer depends on its location and square footage. Real estate data analytics solutions brings in many other factors, such as local market conditions, comparative properties, and even future developments.

This comprehensive data analysis results in more precise valuations, leading to more informed investment decisions.

Predictive Analytics in Real Estate

Imagine being able to predict the future of the real estate market. Sounds great, right? Well, predictive analytics makes this possible to a certain extent.

By studying past trends and current data, predictive analytics offer insights into future market behavior. This insights are key when making informed decisions about when to buy or sell properties.

Data-Driven Decision-Making in Real Estate

Real estate data analytics is like a compass in the vast ocean of real estate investment.

Analyzing relevant data provides direction, aids site selection, and helps identify potential challenges. Consequently, this empowers decision-makers to make choices grounded in real-time data and analytics rather than relying on instinct or outdated information.

Enhanced Property Valuation

Traditional property valuation involves methods such as comparing recent sales of similar properties. This analysis can be enhanced with data analytics.

Data analytics can provide a more precise and comprehensive property valuation by factoring in a broader range of data including:

- Future developments.

- Local market conditions.

- Tenant satisfaction.

Risk Assessment

Real estate investments come with inherent risks, including market volatility, property damage, and vacancy rates.

Data analytics can help investors assess and mitigate these risks by providing insights into market stability, property condition, and tenant reliability.

Real Estate Analytics Tools: The Role of Heat Maps

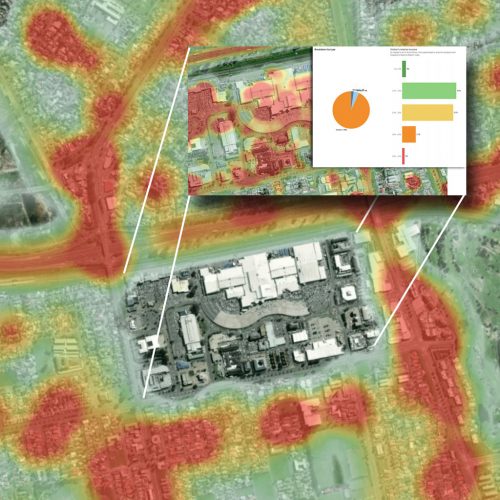

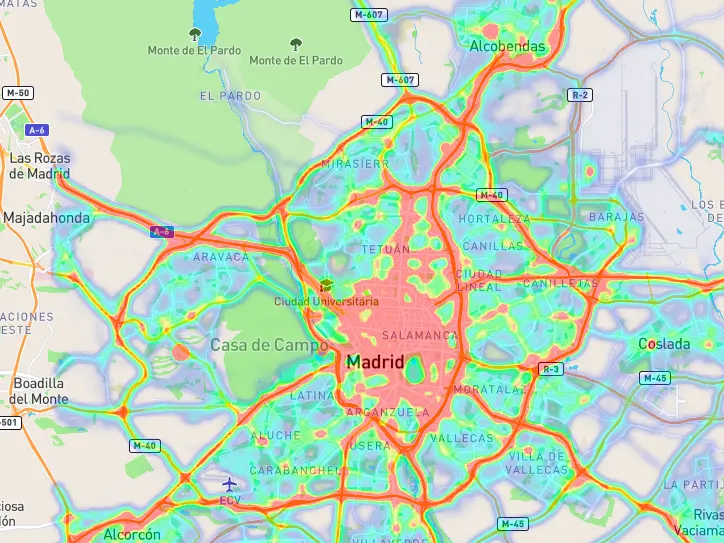

Heat maps are a powerful visual tool used in real estate data analytics to represent data in a two-dimensional graphical format. They use color gradients to indicate varying degrees of intensity or concentration, making complex data sets easily understandable.

In the context of real estate analytics, heat maps play several significant roles:

1. Identifying Trends and Patterns: Heat maps can help visually identify trends and patterns in the real estate market. For example, a heat map could represent the average home prices across a city, with higher prices in warmer colors and sizes with lower prices in cooler colors.

2. Geographic Analysis: Heat maps are handy for geographic analysis, as they can represent data on a map. This could include data such as population density, crime rates, or school ratings, which are essential for real estate decision-making.

3. Comparative Analysis: Heat maps can also facilitate comparative analysis. For example, you could compare the performance of different properties in a real estate portfolio.

4. Risk Assessment: Real estate investors can use heat maps to assess risks associated with specific locations. For example, a heat map showing flood zones or crime rates can help investors avoid high-risk areas.

Commercial vs. Residential Real Estate Data Analytics

Commercial and residential real estate are distinctly asset classes, each with unique characteristics, demands, and data points. As such, the application and focus of data analytics differ.

Commercial Real Estate Data Analytics

Commercial real estate (CRE) includes properties used exclusively for business purposes, like office buildings, warehouses, retail centers, and apartment complexes. Data analytics in CRE often focuses on understanding market trends, rental yields, tenant demographics, and occupancy rates, among others.

For instance, in the office market, investors might be interested in data points like foot traffic, vacancy rates, and average lease terms.

On the other hand, a retail property investor may consider consumer spending habits, store performance, and location demographics.

By analyzing these data points, stakeholders can make informed decisions about property valuations, potential investments, and asset management strategies.

Also, by studying tenant data, a commercial landlord can better understand their tenants’ behaviors and preferences. This understanding is useful to maintain high occupancy rates and tenant satisfaction.

Residential Real Estate Data Analytics

Residential real estate involves properties for personal living, such as houses, condominiums, and townhomes.

In this sector, data analytics could focus more on factors like neighborhood safety, school districts, and local amenities. After all these factors are crucial for home buyers.

Additionally, residential real estate analytics consider home prices, historical sales data, and housing demand to predict future market trends. For example, real estate investors can analyze home price trends in a particular area. Then, they can can predict the correct time to buy or sell properties there.

Case Studies of Real Estate Data Analytics

Case Study 1: Effective Use of Analytics in Commercial Real Estate

Consider the case of a commercial real estate firm that adopted data analytics. By leveraging data from numerous sources, they could accurately assess property values, project future returns, and understand market trends.

This allows them to make smarter, data-informed investment decisions that result in significant profit margins.

Case Study 2: Transforming Residential Real Estate with Data Analytics

A residential real estate company transformed its operations by incorporating data analytics into its strategy. Through comprehensive data analysis, they could predict home price trends, understand buyer preferences, and optimize their marketing strategy.

Case Study 3: Predictive Analytics in Action

A real estate data and analytics firm (Also our client) successfully predicted a market shift using their advanced predictive models. By identifying trends and patterns in the market data, they were able to guide their clients to make profitable investment decisions.

The Future of Real Estate Analytics

The future of real estate data analytics looks bright and promising. As more data sources become available and technology advances, we’re seeing trends like hyper-local analysis and real-time analytics emerge.

These trends transform how we understand and interact with the real estate market.

Role of AI and Machine Learning in Real Estate Analytics

AI and Machine Learning are increasingly significant in real estate data analytics. Both technologies can analyze vast amounts of data more quickly and accurately than any team of human analysts.

This allows for more precise predictions, smarter insights, and ultimately, more informed real estate decisions.

Real-Time Analytics

With the proliferation of IoT devices and real-time data feeds, real estate analytics will increasingly operate in real-time. This will allow for more timely and responsive decision-making.

For example, real estate agencies can adjust property prices in response to real-time market changes. They can also address maintenance issues in a rental property as soon as they occur.

Increased Accessibility

As analytics tools become more user-friendly and accessible, more real estate professionals can leverage data analytics in their workspace.

This democratization of data analytics will lead to more widespread adoption and innovation in the field.

Potential Challenges and Solutions

Despite its potential, real estate data analytics has challenges.

Data Quality and Integrity: One of the biggest challenges in data analytics is ensuring the quality and integrity of the data. Incomplete, inaccurate, or outdated data can lead to misleading results and poor decision-making.

Data Privacy: With the increasing amount of personal data being used in analytics, privacy concerns are vital. Misuse of data can lead to legal repercussions and damage to a company’s reputation.

Skills Gap: Data analytics requires a specific set of skills, including statistical analysis, data mining, and machine learning.

However, there’s often a gap between the skills needed and those available within a company or a real estate team.

Interpreting Data: Simply having data isn’t enough. It’s essential to analyze and turn it into actionable insights. This can be challenging, mainly when dealing with complex or large data sets.

Data Silos: Data silos occur when data is stored separately across different departments or systems, making it difficult to access and analyze holistically.

While these challenges can be daunting, they can be effectively managed with the right strategies and tools in place, paving the way for successful real estate data analytics implementation.

Key takeaways

The importance of data analytics in real estate is undeniable.

With the continuous advancements in technology, particularly in Big Data, AI, and Machine Learning, the future of real estate analytics looks promising.

Success in this market depends on the ability to use data effectively. Real Estate professionals must be able to interpret the data and use it to inform decisions.

That is why you sould be embracing real estate data analytics now. It could be the difference between success and survival in the ever-evolving real estate market.

Use Real Estate Data Analytics in your favor

Schedule a 30 minute meeting with one of our data experts to understand how can we work together and develop the perfect Big Data solutions for your organization.

Our solutions have helped some of the most important corporations in the US, Europe, Latin America, and Asia Pacific.